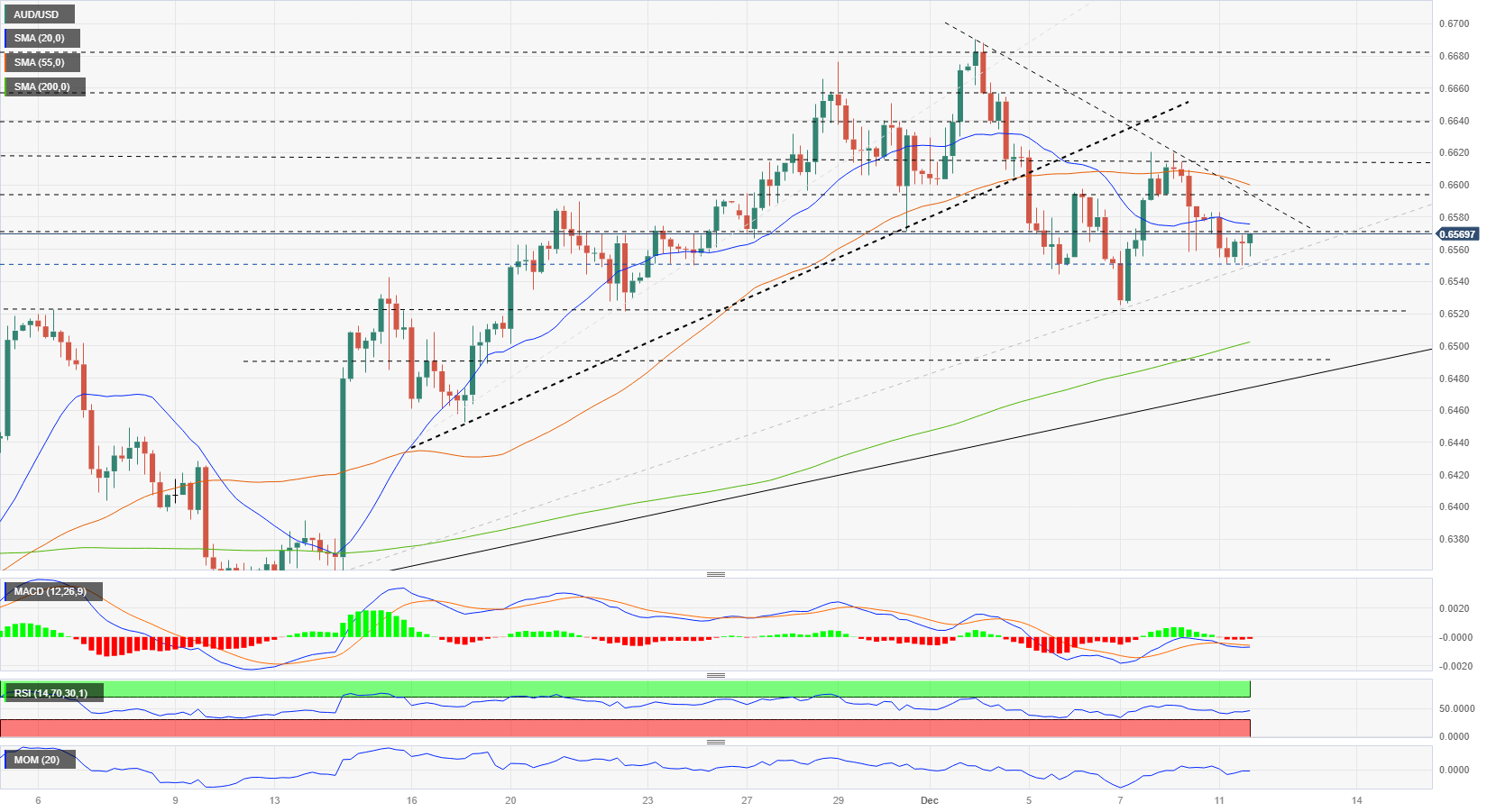

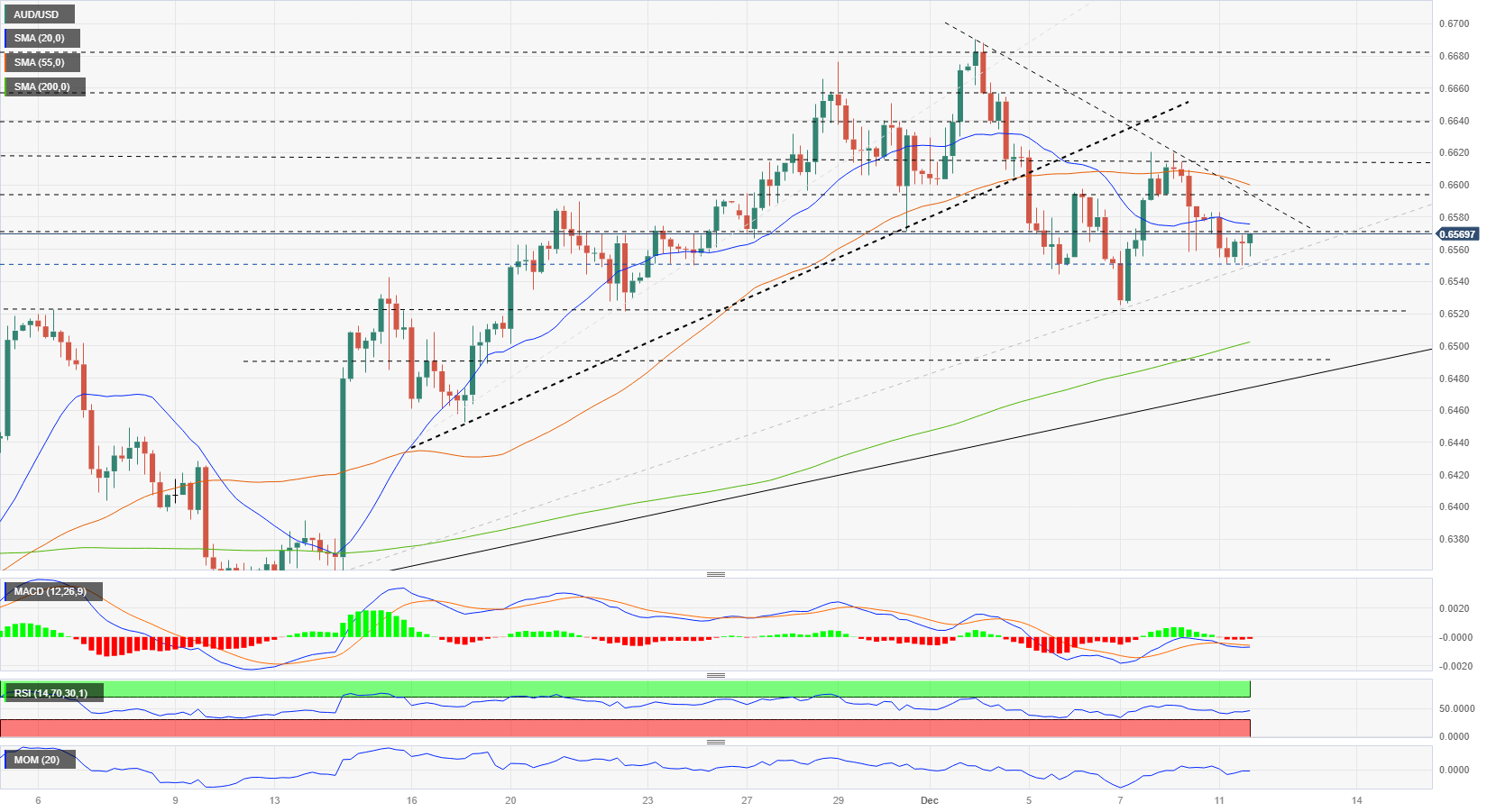

AUD/USD Current Price: 0.6567

- A quiet start to a busy week that includes US CPI, FOMC, and Australian jobs.

- The AUD/USD is consolidating near the 20-DMA.

- Technical indicators offer no clear signs in the short term.

The AUD/USD remains steady around 0.6560 as the week begins, which includes an FOMC meeting and the Australian jobs report. Price action is expected to pick up. In the short-term, the bias is mixed, with the US Dollar Index up but below the recent high of 104.30.

Reserve Bank of Australia (RBA) Governor Michele Bullock will speak at the Australian Payment Network Summit in Sydney on Tuesday. In terms of economic data, the Westpac Consumer Confidence report is due, along with the National Australia Bank’s Business Confidence survey. On Thursday, the Australian employment report will be released.

The US Dollar Index rose on Monday but remained below last week’s highs. A modest increase in US yields supported the Greenback. However, gains were limited as equity prices on Wall Street were posting gains.

On Tuesday, the US Consumer Price Index (CPI) will be released, with a slowdown in the annual rate expected from 3.2% in October to 3.1% in November. These figures are unlikely to change the outcome of the FOMC meeting starting on Tuesday. The Fed is expected to keep rates unchanged.

AUD/USD short-term technical outlook

The AUD/USD is hovering around the 20-day Simple Moving Average (SMA) and the 200-day SMA. Technical indicators on the daily chart are not providing clear signals. Momentum is flat as it approaches the midpoint, while the Relative Strength Index (RSI) is moving south but also flattening. A daily close above 0.6600 would strengthen the short-term outlook for the Aussie, while a decline below 0.6540 could lead to a slide towards 0.6510 initially.

On the 4-hour chart, the price is below the 20-period SMA, but technical indicators are flat. There is no clear bias in the short-term, and the price is likely to continue to consolidate around the current level until the next catalyst. Ahead of the Asian session, if the AUD/USD rises above 0.6575, it could test 0.6600, while a drop below 0.6550 may lead to further weakness.

Support levels: 0.6550 0.6525 0.6485

Resistance levels: 0.6595 0.6625 0.6655

(This story was corrected on December 11 at 19:12 GMT to say that the US Dollar Index rose on Monday. A previous version of the story said that the USD declined.)