AUD/USD Current Price: 0.6703

- US Dollar mixed, supported by a modest rebound in Treasury yields.

- RBA meeting minutes are to be released on Tuesday.

- The AUD/USD reached a fresh monthly high but failed to hold above 0.6730.

The AUD/USD hit a fresh four-month high on Monday at 0.6735, slightly above last week’s highs, and then pulled back. The pair continues to trade around 0.6700 as the US Dollar remains weak; however, it is stabilizing as Federal Reserve (Fed) officials pushed back against easing expectations.

On a quiet Monday, most currency pairs offered limited price action. AUD/USD moved sideways after being unable to break above 0.6730. After reaching the fresh high, it pulled back to the 0.6695 area amid a stronger US Dollar due to higher Treasury Yields. Nonetheless, the pair remains near recent multi-month lows. Market sentiment sees the Fed cutting interest rates in the first half of next year, but it is not being considered as a base case scenario by Fed officials.

Until the market focus shifts back to activity data, the US Dollar could remain under pressure. The key report in the US this week will be on Friday with the Core Personal Consumption Expenditure Price Index (Core PCE) which, if it shows further deceleration, could weigh on the US Dollar.

Last week, labor market data from Australia surpassed expectations but did not boost the Aussie. On Tuesday, the Reserve Bank of Australia (RBA) will release the minutes of its latest meeting. However, no surprises are expected. It will be a quiet week in terms of economic data in Australia.

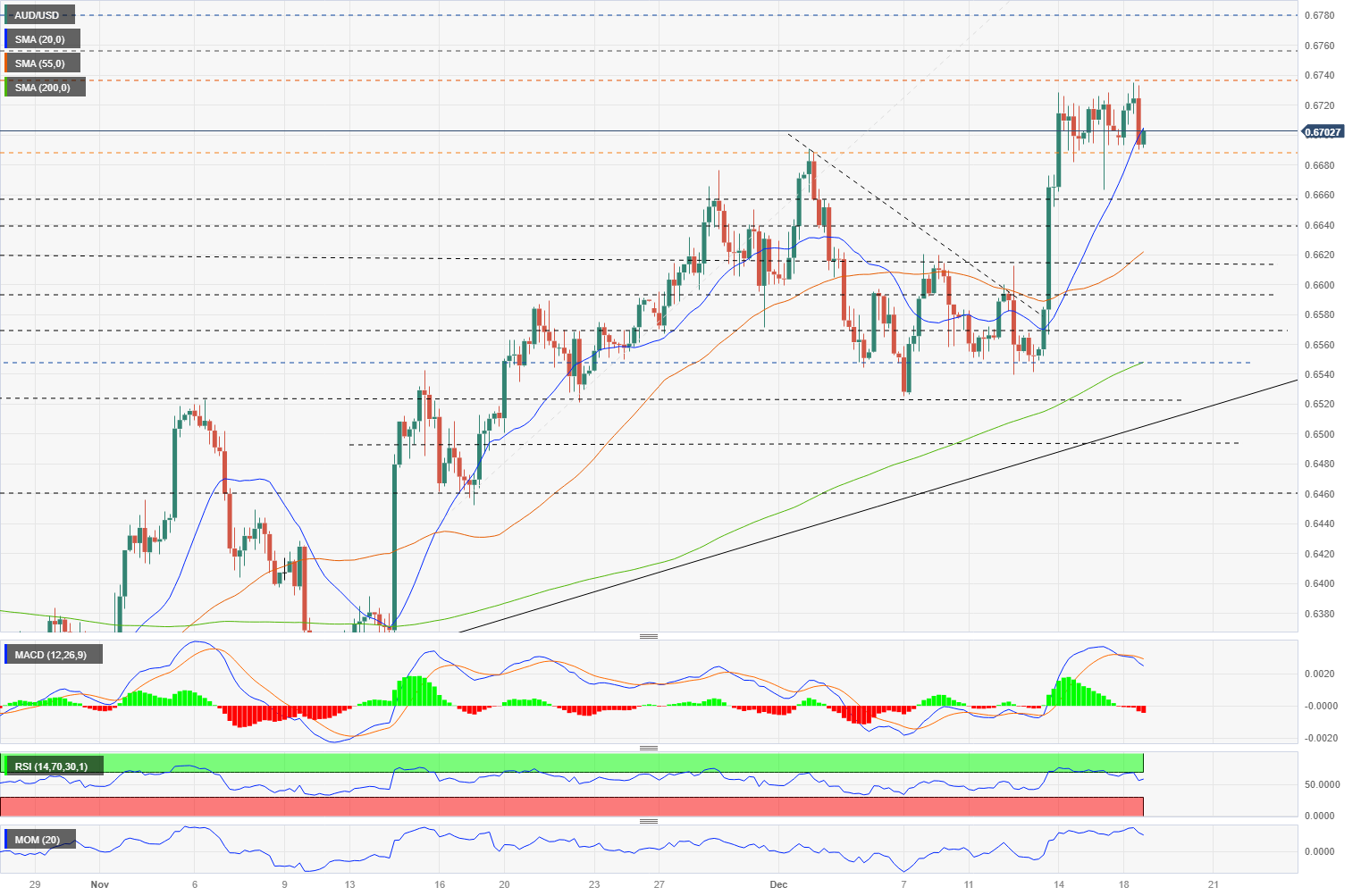

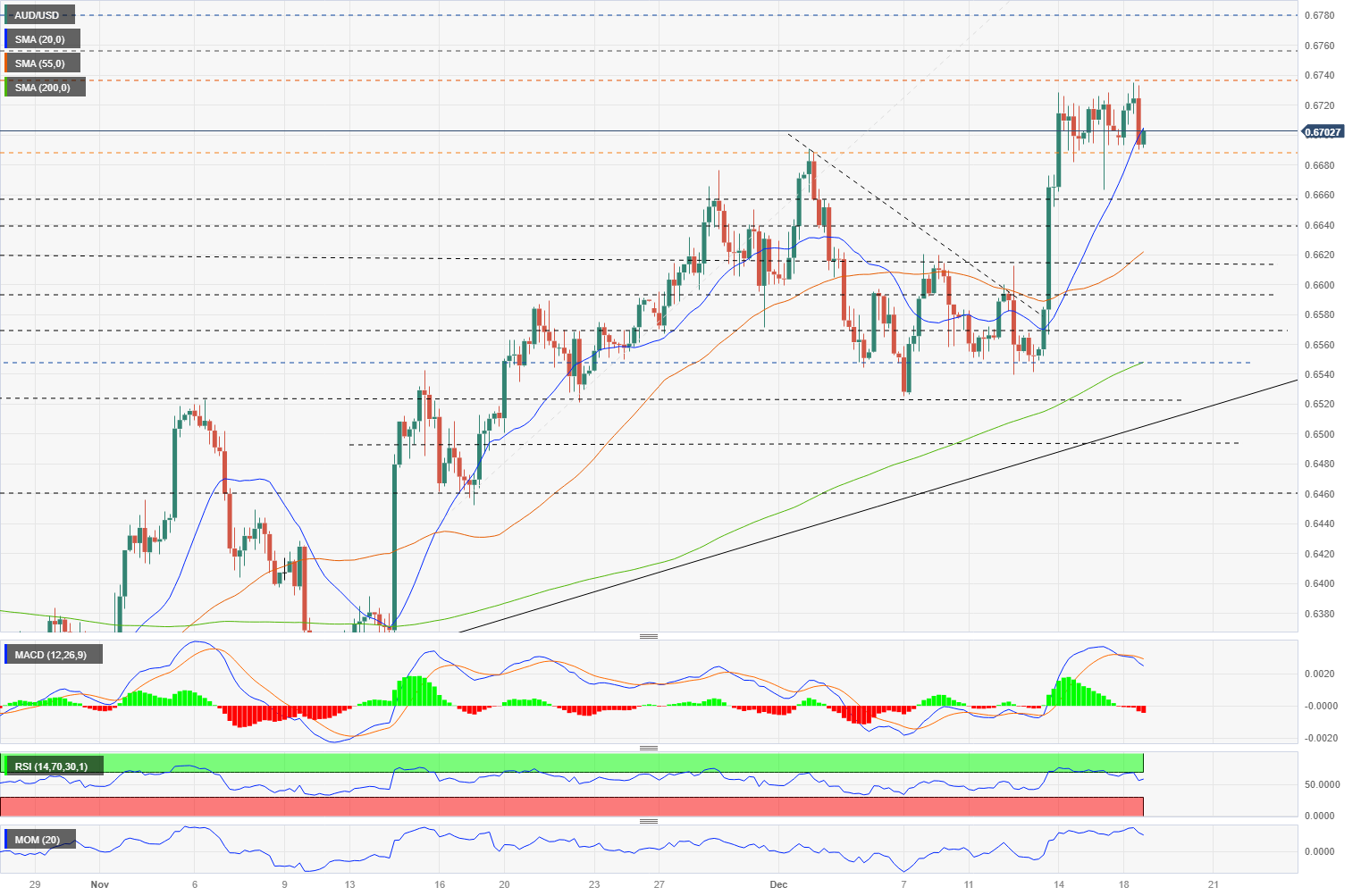

AUD/USD short-term technical outlook

The AUD/USD remains within a bullish channel, with strong support at the 20-day Simple Moving Average (SMA) and a dynamic support at the 0.6570 zone. A decline below this mentioned area would change the bias from bullish to neutral. If the pair gains momentum and rises sharply, it is expected to encounter sellers around the 0.6800 level, triggering a retreat.

On the 4-hour chart, technical indicators are showing signs of weakness. The MACD has turned bearish, the Relative Strength Index (RSI) is moving south, and Momentum is also declining. However, as long as the price remains above 0.6690, the downside potential should be limited. Below that area, a further correction towards 0.6660 appears likely. On the other hand, consolidation above 0.6730 would suggest a potential move towards fresh cycle highs.

Support levels: 0.6690 0.6660 0.6620

Resistance levels: 0.6735 0.6760 0.6795