- Gold attracts some dip-buying amid a softer risk tone and a modest USD downtick.

- The fundamental backdrop favours bulls and supports prospects for further gains.

- Breakout through a short-term trading range is needed to reaffirm the positive bias.

Gold price (XAU/USD) regains positive traction on Thursday and reverses a major part of the previous day’s downfall amid the underlying bearish sentiment surrounding the US Dollar (USD). Growing acceptance that the Federal Reserve (Fed) will pivot away from its hawkish stance and start cutting interest rates as early as March 2024 drag the US Treasury bond yields to a multi-month low. In fact, the yield on the benchmark 10-year US government bond drops to its lowest level since July and undermines the Greenback, benefitting the US Dollar-denominated commodity. Apart from this, a softer risk tone around the equity markets is seen as another factor driving haven flows towards the precious metal.

Meanwhile, the prospect of a global rate-cutting cycle suggests that the path of least resistance for the non-yielding Gold price remains to the upside. The median forecast in Federal Open Market Committee (FOMC) members’ Summary of Economic Projections has the federal-funds rate ending 2024 at 4.6%, signalling three 25 basis points (bps) rate cuts. Meanwhile, the CME Group’s FedWatch Tool indicates that the markets are pricing in a cumulative of around 150 bps rate cuts by the end of next year. Adding to this, a big drop in the UK inflation during November, to its lowest rate in over two years, lifted bets that the Bank of England (BoE) will also start cutting interest rates in the first half of next year.

Furthermore, the recent run of softer-than-expected inflation data from the Eurozone, along with the softening in rhetoric from several European Central Bank (ECB) members, suggest that the risk has now shifted towards earlier rate cuts. That said, Fed and ECB officials have been pushing back against market bets for rapid interest rate cuts next year. This, in turn, is holding back bulls from placing aggressive bets around the Gold price. Traders also prefer to wait on the sidelines ahead of the US Core Personal Consumption Expenditure (PCE) Price Index, due on Friday, which might influence the Fed’s future policy decision and provide a fresh directional impetus to the non-yielding yellow metal.

In the run-up to the key data risk, traders on Thursday will take cues from the US economic docket – featuring the final Q3 GDP print, the usual Initial Weekly Jobless Claims and the Philly Fed Manufacturing Index. This, along with the US bond yields, will drive the USD demand and provide some impetus to the Gold price later during the early North American session. Apart from this, the broader risk sentiment should further contribute to producing short-term opportunities. Nevertheless, the aforementioned fundamental backdrop seems tilted firmly in favour of bullish traders.

Technical Outlook

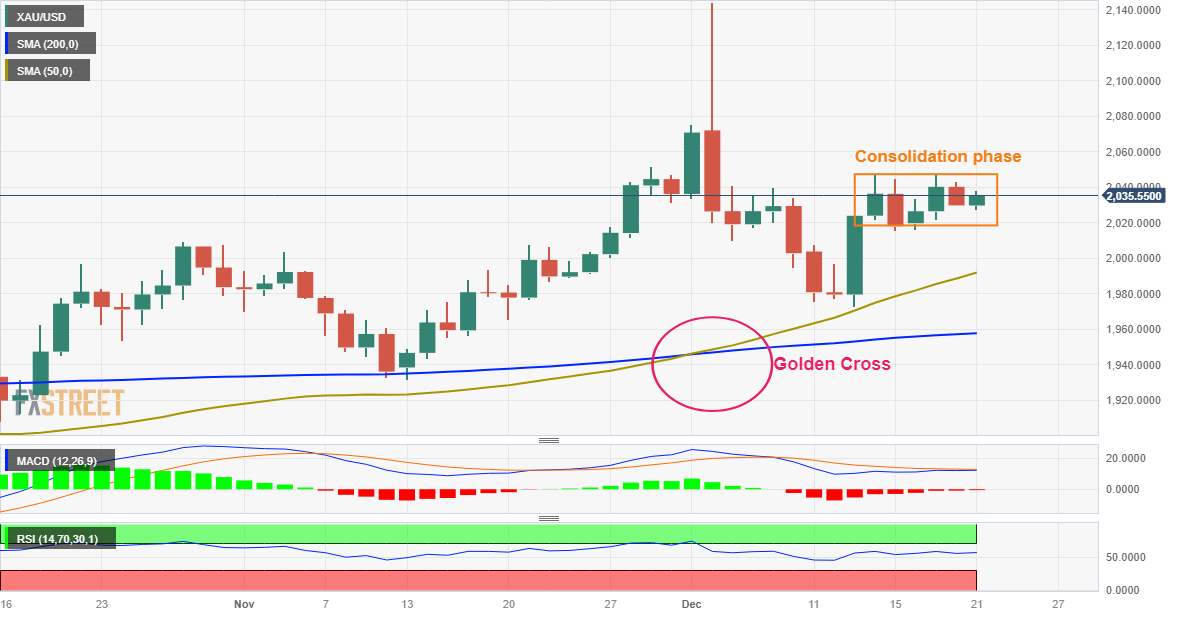

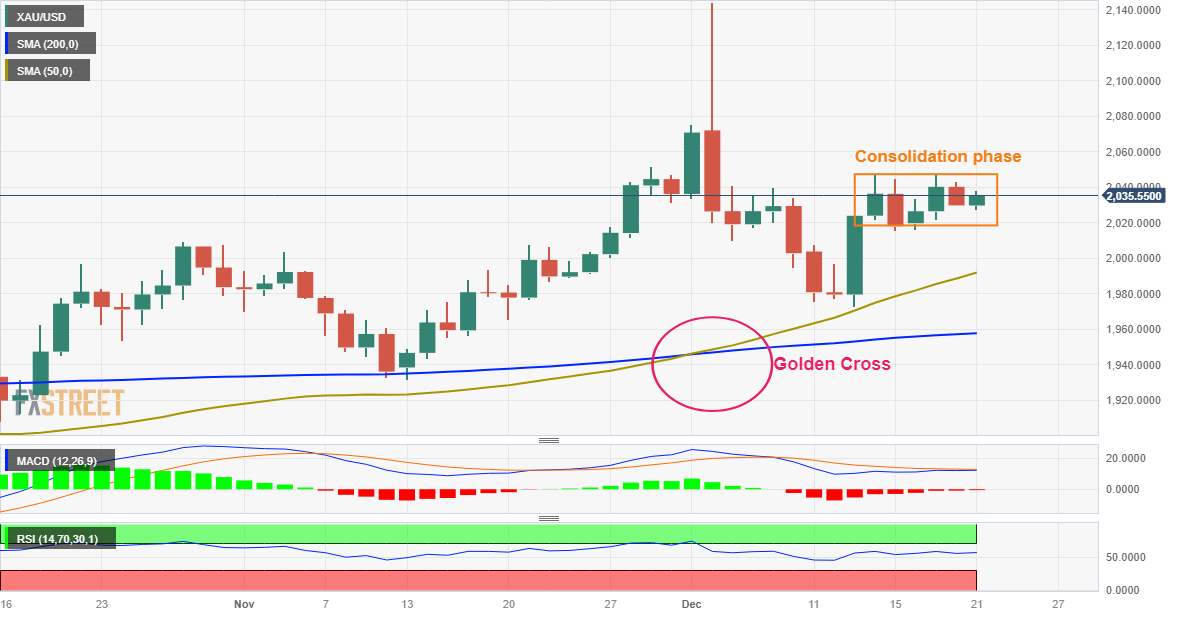

From a technical perspective, the recent range-bound price action constitutes the formation of a rectangle pattern on short-term charts and marks a consolidation phase before the next leg of a directional move. Against the backdrop of last week’s post-FOMC rally from the vicinity of the 50-day Simple Moving Average (SMA), the occurrence of a golden cross, with the 50-day SMA holding above the 200-day SMA, favours bullish traders. Furthermore, oscillators on the daily chart are holding in the positive territory and are still far from being in the overbought zone, validating the constructive outlook for the Gold price.

That said, it will still be prudent to wait for a sustained breakout through the top boundary of the aforementioned trading band, around the $2,047-2,048 region, before positioning for any further appreciating move. The XAU/USD might then accelerate the positive move towards the next relevant hurdle near the $2,072-2,073. The momentum could get extended further and allow the Gold price to reclaim the $2,100 round figure.

On the flip side, immediate support is pegged near the $2,028-2,027 region. This is followed by the $2,017 zone, or the lower end of the trading band, which if broken might shift the short-term bias in favour of bearish traders. The subsequent decline could then drag the Gold price to to the $2,000 psychological mark en route to the 50-day SMA, currently near the $1,992-1,991 area. The XAU/USD could then drop towards last week’s swing low, around the $1,973 region, and decline further to a technically significant 200-day SMA, near the $1,957 zone.