- The Federal Reserve hinted at a pivot, the European Central Bank is still on hold.

- Bets that central banks will cut rates in the upcoming months are way too optimistic.

- EUR/USD aiming to extend gains in the first half of 2024 amid sentiment trading.

If 2023 could be described with one word, that would be “sentiment”. Through the last four years, the world has become a different one, and so have investors’ mindsets. As this year ends, some vestiges of normality are peeping in the near future, although the road is still long.

Let’s take a brief look into the past. The pandemic from 2020 interrupted global economic activity amid widespread lockdowns. The world woke up from the lethargy in 2021 and attempted to return to normal, failing miserably on the matter. Governments assumed debts that are still due, and central banks were caught off guard.

Why? Because the decision to stall all activity forced governments to come to the rescue with financial support for businesses and households alike. Easy money and the end of lockdowns resulted in skyrocketing price pressures, with inflation in most developed economies hitting multi-decade peaks in mid-2022.

As a result, global central banks engaged in massive rate hikes tied to increased recessionary risk. The United States (US) Federal Reserve (Fed) led the way, but apart from the Bank of Japan (BoJ), all major central banks followed.

Indeed, inflation receded in the second half of 2022, with market hopes undermining demand for the safe-haven US Dollar. The EUR/USD pair ended 2022 at around 1.0700 after bottoming at 0.9535 a few months before.

2023 Recap: The year of hope

As the Federal Reserve also took the lead on slowing the pace of rate hikes, financial markets turned optimistic and timidly considered a potential shift in monetary policy. Anyway, policymakers at both shores of the Atlantic pledged at the end of 2022 to additional rate hikes and kept their word.

The Fed pulled the trigger seven times through 2022, lifting the benchmark rate from 0.00%-0.25% to 4.25%-4.50%. It added then four more 25 basis points hikes through 2023, bringing rates to 5.25%-5.50% in July.

Across the pond, the European Central Bank (ECB) delivered four hikes on the Main Refinancing Rate, lifting it from 0.0% to 2.50% in 2022. The ECB continued with six more hikes in 2023, bringing it to 4.50% in September.

It’s clear that the ECB took a more conservative approach to monetary tightening, and there are good reasons beyond it. The imbalances between the different economies that are part of the European Union (EU) merit delicate movements, as the common monetary policy needs to fit flourishing economies with those perpetually battling with deficits and poverty.

As the year went by and rates continued to rise, market participants began wondering whether central banks could tame inflation while dodging economic setbacks. Concerns about widespread recessions pushed investors back into the safe-haven US Dollar. Central bankers fueled growth-related preoccupations as Fed Chairman Jerome Powell and ECB President Christine Lagarde converged to put controlling inflation above economic growth.

Still, and as inflationary levels continued to recede, hopes increased. By the end of the first quarter of 2023, market players began talking about rate cuts. As price pressures eased further, bets increased despite policymakers’ warnings against them.

By mid-2023, central bankers made modest tweaks to their rhetorics. Inflation remained the main concern, but instead of insisting on continued hikes, they introduced the “higher for longer” concept, keeping rates at restrictive levels sufficiently enough to grant stable and on-target inflation.

Policymakers could stir the pot throughout the year, and December went by without the so-longed rate cuts. However, it has become clear loosening the monetary policy is the next step.

The shift to a more conservative approach came by the hand of fear. Inflation continued to ease, but growth remained on the back foot.

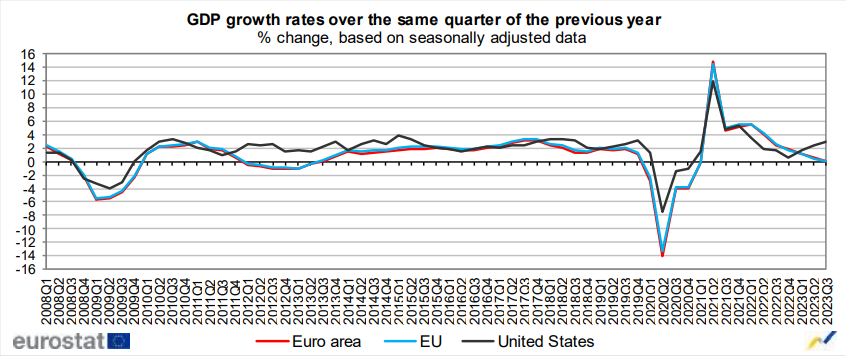

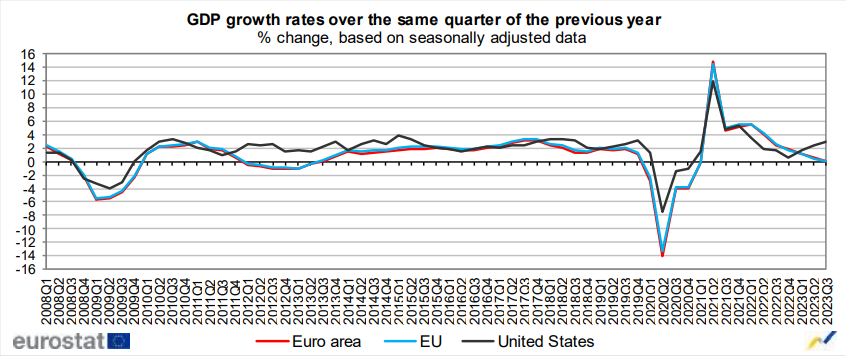

According to the latest available data, Q3 seasonally adjusted Gross Domestic Product (GDP) decreased by 0.1% in the Euro Area and remained stable in the EU, compared with the previous quarter, according to a flash estimate published by Eurostat. In the second quarter of 2023, GDP grew by 0.2% in the Euro Area and remained stable in the EU.

Compared with the same quarter of the previous year, seasonally adjusted GDP increased by 0.1% both in the Euro Area and in the EU in the third quarter of 2023, after +0.5% in the Euro Area and +0.4% in the EU in the previous quarter.

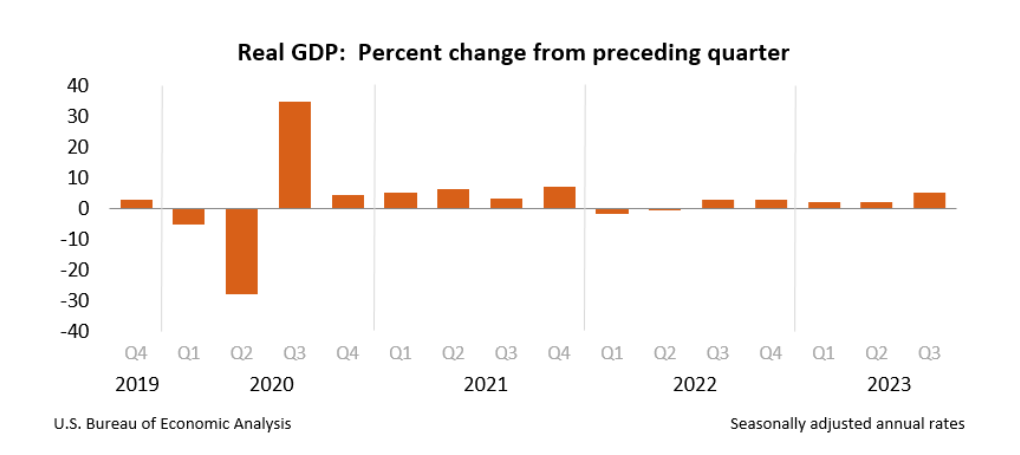

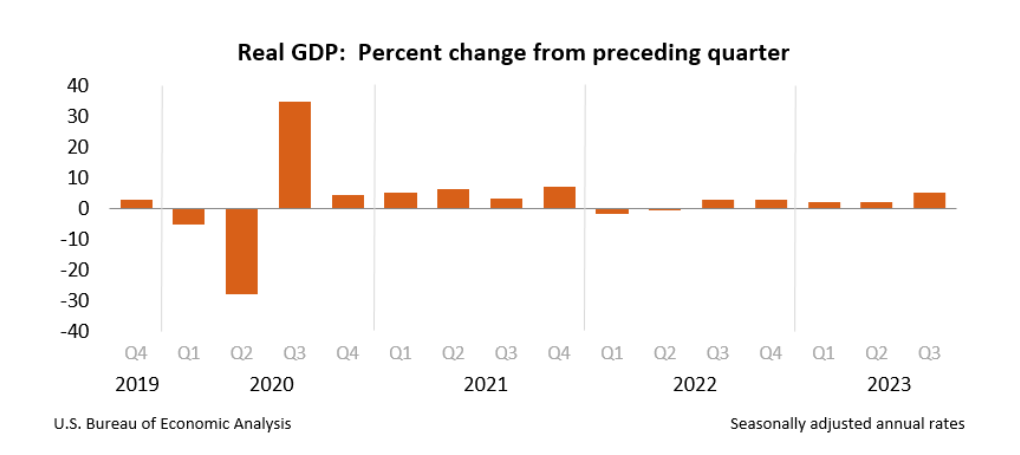

In the US, Real GDP increased at an annual rate of 4.9% in the third quarter of 2023, according to the Bureau of Economic Analysis (BEA). In the second quarter, real GDP increased 2.1%. The increase in the third quarter primarily reflected increases in consumer spending and inventory investment.

Bottom line, this year, we learned the US economy remained resilient and even posted some healthy growth. We still have to see the bottom in Europe. The United States may face a soft landing indeed, but the odds for such an event are decreasing sharply, particularly after the December Fed monetary policy meeting. On the contrary, the EU economy still points to a recessionary in 2024.

2024: The job is not yet done

As 2023 comes to an end, financial markets keep trading on sentiment. The US Dollar falls while the Euro rises as confidence reigns. Optimism is pushing Wall Street higher and government bond yields down, which are signs of easing fears.

Following the December central banks’ meetings, market participants believe monetary tightening is over, and pivot time has come. For the first time, the Federal Open Market Committee (FOMC) did not push back against the market’s expectations of rate cuts. In fact, the Summary of Economic Projections (SEP) anticipated at least three 25 basis points (bps) cuts for 2024. Furthermore, Chairman Jerome Powell said discussing rate cuts amid cooling inflation “will be a topic for us looking ahead.” Overall, the Fed was read as dovish, as the central bank also decided to keep the benchmark interest rate steady for a third consecutive meeting.

The European Central Bank, however, is standing two steps behind. President Christine Lagarde noted policymakers did not discuss rate cuts “at all.” She said cutting rates too soon would be like passing “from solid to gas without going through the liquid phase.” Still, the ECB has maintained its rates unchanged since the September meeting.

Policymakers continue to warn market participants that their decisions are linked to inflationary pressures, adding that restrictive monetary conditions may need to remain longer than anticipated. So far, no one has explicitly said raising rates further could do more harm than good.

Market players are already pricing in that rate cuts would start between April and May and keep trading on sentiment, that is, selling the American currency against the Euro.

But that seems way too optimistic. The risks to inflation are still present, mostly coming from relatively tight labor markets. The pressure from the job sector has eased but is far from loose. The International Monetary Fund (IMF) projects a soft landing, “bringing inflation down without a major downturn in activity, especially in the United States, where our forecast increase in unemployment is now modest, from 3.6% to 3.9% by 2025.”

That could be the stone in the Fed’s shoe. If the employment sector remains tight, inflation may pick up, and the central bank may opt to pull the trigger one more time before engaging in rate cuts.

Across the pond, the ultra-conservative ECB will hardly make a movement before the Fed nor act during the current economic contraction.

With the wind in favor, the Fed could trim interest rates in the year’s second half. The ECB could then act in the last quarter of 2024.

That opens the door to sentiment to continue to lead the way, regardless of economic strength or weakness, at least through the first half of the new year. The change to data-related trading will be slow and painful and could begin by the end of 2024.

US Presidential election

There is a note of color that would stand out in the upcoming months: the US 2024 presidential election that will take place on November 5. The contest nomination will start as soon as January and run until June.

The pinch of drama comes from Donald Trump’s desire to represent Republicans once again. A court in Colorado ruled that he cannot run for president due to the events that took place before the 2021 Capitol attack. The Supreme Court has the last saying and would need to determine if Trump is eligible to be on the ballot in the next couple of weeks.

A potential second government of Donald Trump could mean higher inflationary pressures as Trump could reintroduce tariffs on imports and push against the agreements between China and the Biden administration.

EUR/USD 2024 Technical Outlook

The EUR/USD pair traded as low as 1.0447 and as high as 1.1275 throughout 2023, with currencies moving on sentiment. It started the year around 1.0700 and changes hands below 1.1000 as the year comes to an end, as risk-related trading continues. The broader technical perspective leans the scale in the Euro’s favor, as the monthly chart shows that the buyers are defending the downside around the 20 Simple Moving Average (SMA), which has lost its bearish strength and currently stands at around 1.0600.

At the same time, the 100 SMA also lacks directional strength, acting as dynamic resistance at around 1.1250. With the 2023 yearly high at 1.1275, the 1.1250/1.1300 region seems a potential target and a critical breakout area. The same chart shows bulls hold the grip, although hesitating as EUR/USD seems unable to conquer the 1.1000 psychological threshold. Technical indicators hold within positive levels but without directional strength.

The bullish potential is a bit more clear in the weekly chart, anticipating gains for the next couple of months. EUR/USD is comfortably developing above its 20 and 100 SMAs, while a flat 200 SMA provides dynamic resistance at around 1.1160, the first target once the pair takes out the 1.1000 mark. Meanwhile, technical indicators gain upward traction within positive levels after bouncing from around their midlines.

The ultimate bullish target for EUR/USD is the 1.1470 price zone and historically strong static resistance area.

Bear in mind that the US Dollar’s self-strength could kick in anytime, although hardly in the first quarter. The 1.0700 level will be the first line in the sand en route to the 1.0447, the 2023 yearly low. The Eurozone economy would need to show steady signs of recovery to prevent EUR/USD from collapsing below 1.0390 in the year’s second half.