- The US Dollar gained more than 10% versus the Japanese Yen during 2023, a performance that will be hard to repeat in 2024.

- The divergence in monetary policy between the Federal Reserve and the Bank of Japan led the pair to test the multi-decade high near 152.00.

- USD/JPY broke a one-year bullish trend in December after failing to break 152.00, setting a bearish bias for the first quarters of 2024.

- Yen bulls have hope in the Bank of Japan, while US Dollar buyers rely on the US economy.

The United States Dollar (USD) had a mixed performance during 2023, supported mainly by the robust US economy and limited by the rally on Wall Street. On the other hand, the Japanese Yen (JPY) went from verbal intervention aimed at limiting its depreciation to rally on every speculation and rumor regarding a potential shift in the Bank of Japan’s (BoJ) ultra-loose monetary policy. However, these expectations faded as the BoJ clarified that it is still far from implementing any changes.

In December, the Yen experienced a recovery as markets perceived that the Fed would not raise interest rates further, and there were comments about an exit strategy at the BoJ. As a result, the Japanese currency is ending 2023 with positive momentum against the US Dollar. This is similar to what happened in 2022 when USD/JPY dropped after establishing a new multi-decade high near 152.00. In 2023, the pair also retreated from 152.00, but at a more moderate pace.

Federal Reserve rate hike cycle ends, US yields change trend after hitting multi-year highs

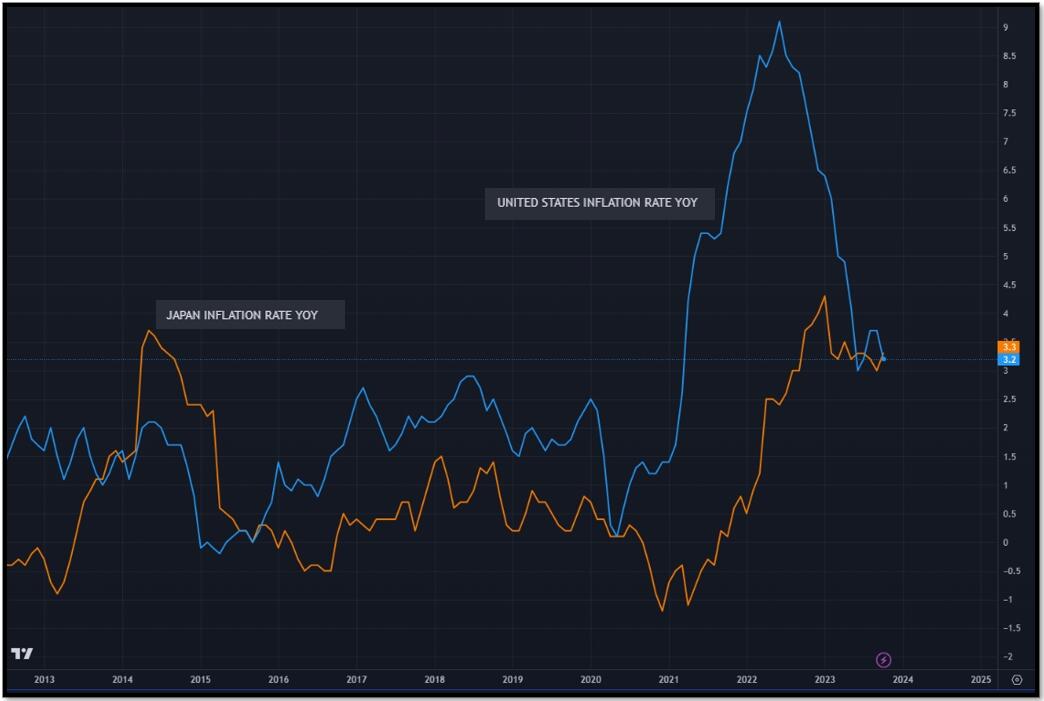

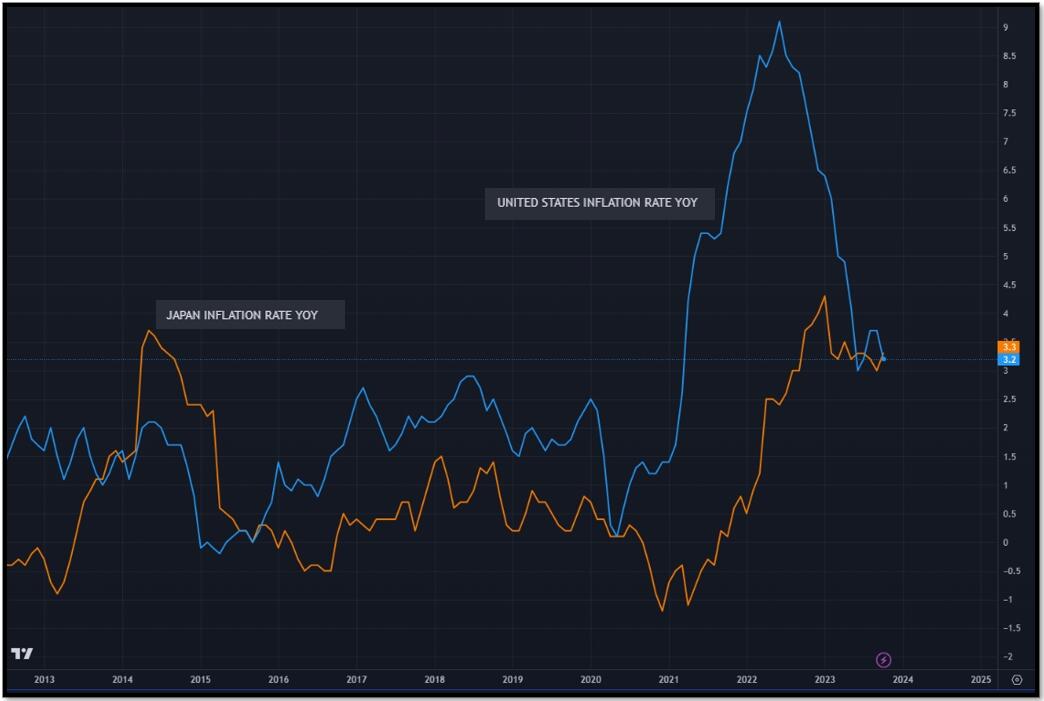

During 2023, inflation in the US continued to trend lower, retreating from the peak above 9% in 2022. The annual inflation rate bottomed in June at 3.0% and then rebounded moderately but resumed its downward trend. This decline is expected to continue toward the Fed’s objective as monetary tightening takes effect and the US economy slows down.

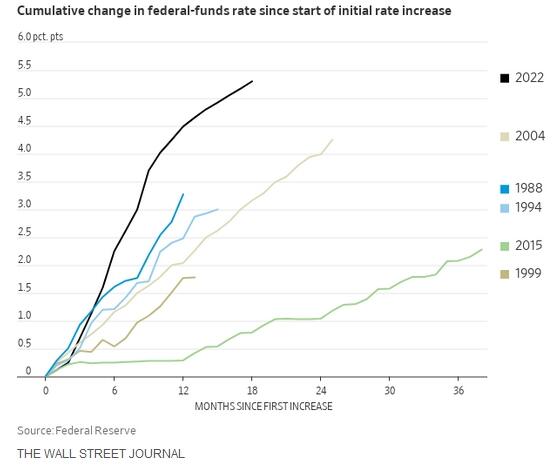

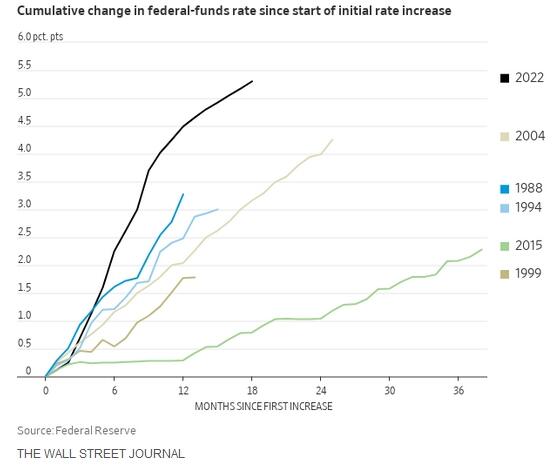

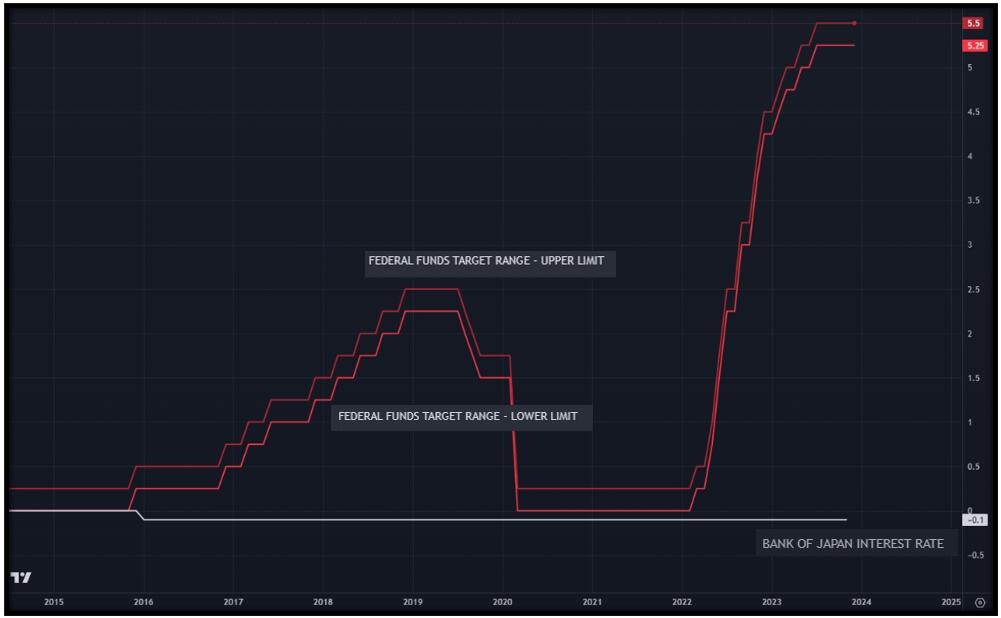

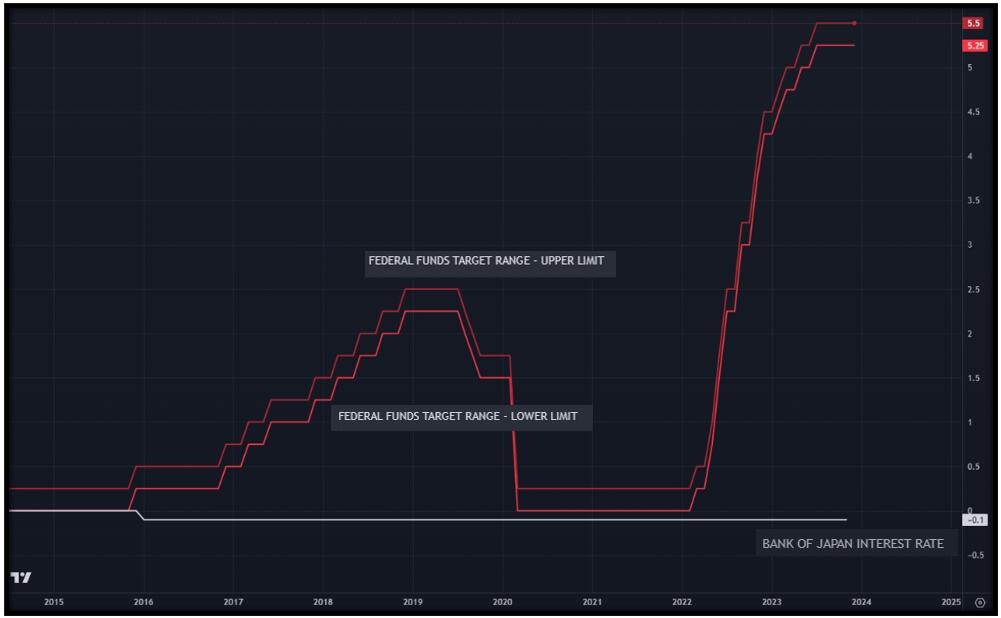

The deceleration in inflation alleviated the need for the Fed to raise interest rates further. The fed funds rates rose in 2023 from 4.25%-4.50% to 5.25%-5.50%, reaching the highest level in 22 years and completing the most aggressive tightening cycle in four decades with a cumulative 525 basis points of rate hikes.

US Treasury yields reached their highest point in October but began to decline as evidence suggested that inflation was being brought under control, although still above the target. This decline in yields was also influenced by indications of a more balanced labor market. In October, the US 10-year yield reached levels above 5%, the highest since 2007. This marked the highest point, along with the peak of the United States Dollar Index (DXY). During this time, the USD/JPY pair tested the 152.00 zone in October and again in November, marking the last time it reached that level and then started to correct to the downside.

Just minor changes at the Bank of Japan

The change in leadership at the BoJ in April, when Kazuo Ueda replaced Haruhiko Kuroda as governor, did not result in policy alterations. Although there were initial considerations of a potential shift toward a less dovish stance, there were no changes. What remained consistent was the impact on the Japanese Yen of rumors and speculations about a possible policy shift, causing temporary boosts but fading as the market returned to the understanding that the BoJ remained firmly committed to its ultra-loose monetary policy.

The BoJ maintained its target of -0.1% for short-term interest rates. Regarding its Yield Curve Control (YCC) policy, it kept the 10-year government bond yield around 0%. The BoJ introduced only minor tweaks to its YCC policy, loosening its grip on long-term rates.

At the November meeting, the BoJ “regarded the upper bound of 1.0 percent for 10-year Japanese Government Bond (JGB) yields as a reference in its market operations.” The 10-year yield approached 1%, a level not seen since 2013, prompting intervention from the BoJ through unscheduled bond purchases to maintain control over yields.

In Japan, inflation, as measured by the annual Consumer Price Index (CPI), slowed in January from above 4% to average 3.3% in 2023. Despite inflation staying above the BoJ’s target and higher than the average of the previous decades, the central bank did not make relevant changes to its ultra-loose monetary policy.

The divergence in monetary policies between the United States and Japan remained a supportive factor for USD/JPY throughout the year, reflected in the difference in government bond yields. However, as many analysts forecast, this situation could change in 2024 if the Fed cuts rates and the BoJ finally lifts.

A good year on Wall Street

US equity prices are about to end the year with significant gains. By mid-December, the Dow Jones was up by 10%; the S&P 500, by 20%; and the Nasdaq, an impressive 35% increase. Investors cheered the end of the Fed’s tightening cycle, as well as that of other central banks. The strong performance of the US economy also contributed to an enhanced risk appetite.

The upbeat tone in the equity markets harmed the Japanese Yen, which typically serves as a safe haven currency. The correlation between Wall Street indices and the Japanese Yen fluctuated during 2023, influenced by the Treasury bond market. The regular correlation suggests that US yields tend to decrease when market sentiment turns negative, while yields rise alongside stock price increases.

However, there were instances when US yields dropped despite upbeat markets, which somewhat limited the strength of USD/JPY. On the contrary, when fears of higher interest rates permeated the markets, leading stocks to decline, US yields moved higher, thereby maintaining bullish pressure on USD/JPY.

Divergent monetary policies to continue playing a role in 2024

Divergent monetary policy is expected to continue playing a pivotal role in 2024, along with developments in the bond market. According to a Reuters poll conducted in December, economists anticipate the Fed keeping interest rates unchanged until at least July 2024. The majority of experts view the first rate cut as an adjustment to real interest rates rather than the start of a stimulus cycle. This could weigh on the US Dollar, but it should be limited if the US economy continues to outperform and other central banks cut rates before the Fed. However, it is not against the Japanese Yen as the BoJ is not among those central banks expected to cut rates.

There is a possibility that the BoJ might end its negative interest rate policy (NIRP) by raising the key rate to 0.00% in 2024. Some analysts anticipate the eventual end of YCC by January, while others believe it is more likely to occur during the second quarter. A significant challenge for the BoJ is to exit from NIRP without disrupting the economy.

Governor Kazuo Ueda has emphasized that any move will be carefully calculated, and the central bank will likely prepare the market for a change. This scenario is more likely to materialize if inflation in Japan remains above 3%. In October, the CPI rose on a monthly basis by 0.7%, the highest increase since 2014, potentially indicating the need for tighter monetary policy to bring the annual rate below 3%.

Wage growth is a crucial indicator for the BoJ and will play an essential role in determining policy changes. If inflation slows further in Japan and the economy weakens, the BoJ may lack the incentive to make policy changes.

A significant decline in the Japanese Yen (such as USD/JPY rising above 152.00) would increase pressure on Japanese officials to raise interest rates. As long as the BoJ keeps rates negative while other central banks remain on hold, the Yen’s weakness will likely persist until it abandons its ultra-dovish stance. Attempts by the Ministry of Finance and the BoJ to curb Yen depreciation with an intervention in the currency market are expected to have a short-lived impact, unless it is a global coordinated action.

What do the US recession/soft landing and the BoJ liftoff have in common? They have not happened, and the forecasts for these events have consistently been pushed out.

US: How long will interest rates stay high?

The US economy surprised during the third quarter with a robust annualized growth rate of 5.2%. However, it is expected to have slowed to around 1% in the fourth quarter. This performance indicates that the economy has handled the tightening cycle well. The current economic conditions allow the Fed to consider raising rates further if the central bank deems it necessary. However, economic activity, by itself, does not justify rate increases as the economy is not overheating.

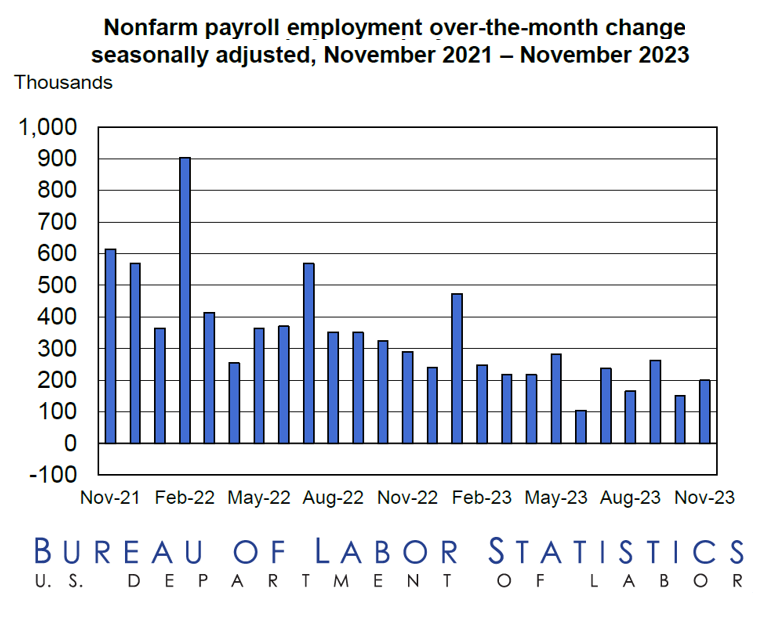

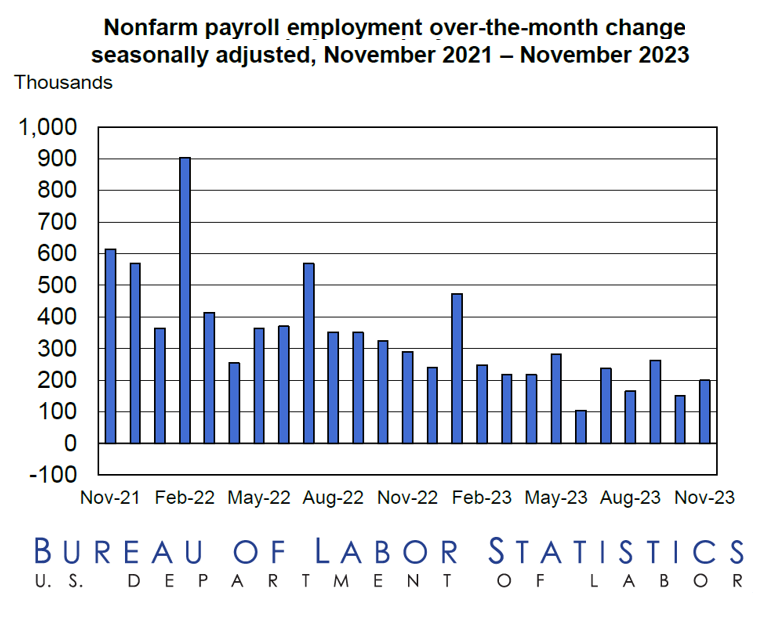

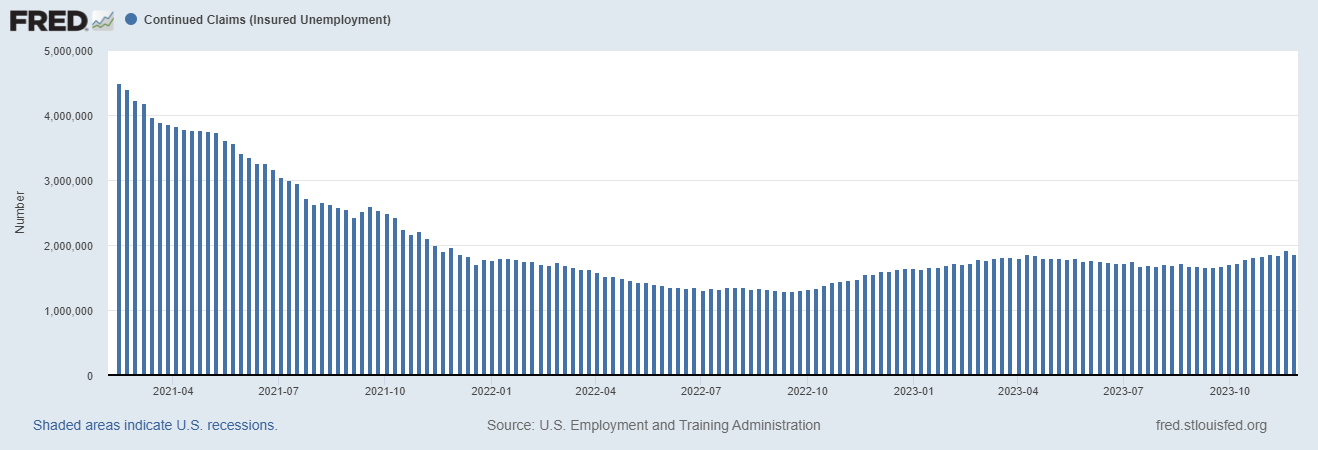

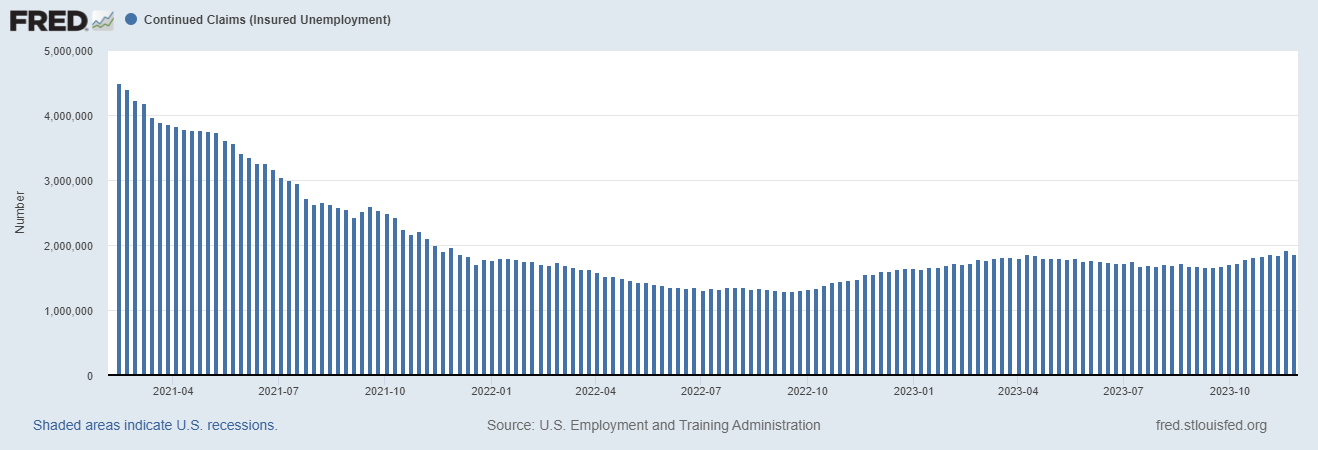

The anticipated “soft landing” predicted for 2023 did not materialize but appears more likely in 2024. Growth is slowing, and the labor market is becoming more balanced, while the economy adjusts to higher interest rates. The most recent payroll report showed a positive increase of 199,000 jobs, in line with the year’s average but lower than the previous year. Continuing jobless claims remain near 2 million, the highest level since early 2022.

US rates are expected to remain high during the first quarter of next year, even if economic data indicates a more pronounced slowdown. Economists argue that the 5.2% growth rate recorded in Q3 will not be repeated soon. After growing above the trend, the growth rate could fall below in 2024.

Expectations about the US economy moderating do not necessarily mean a weaker US Dollar across the board. The US will continue to exhibit positive growth divergence compared to European countries and also compared to Japan. Japan’s GDP contracted at an annualized rate of 2.9% during the third quarter. The divergence between US growth and Japan is expected to persist during the first half of next year.

Geopolitics are in play, critical for the Japanese Yen and the US Dollar

The US Dollar and the Yen, alongside the Swiss Franc, are considered safe haven currencies. The Yen’s recent depreciation to multi-year lows has raised some doubts about this role, but any negative shocks would likely benefit the Yen initially and then the US Dollar.

On November 5, 2024, US citizens will vote for a new president. In January, caucuses and primaries will begin. As of now, the most likely scenario is a rerun of the Trump-Biden election. When Trump won in 2016, the market started to rally after an initial shocking reaction. This time, it may not be the case as Trump is perceived as more extreme.

Technical outlook: 152.00 and 140.00 hold the key for bulls and bears

The past two years were volatile. This suggests that volatility will remain elevated during the first half of 2024. The monthly chart shows USD/JPY failed to break the multi-decade high around 152.00 in October and November before starting to correct lower. The momentum indicator points out that there is further room for a downward correction during the first quarter of next year as long as the upside remains capped by 152.00.

A break above that level would open the doors to a bullish acceleration, at least from a technical perspective, but it remains to be seen if Japanese authorities would allow that to happen. If the upside continues, attention should be focused on round numbers like 155.00 and then 160.00 for targets.

The trend on the chart is up, but the technical indicators and the failure to break 152.00 suggest that the pair is undergoing a correction, and signs indicate that it could likely continue in that direction through 2024. The first relevant solid area around 142.00 is a potential support level. Below that area, the 20-month Simple Moving Average (SMA) near 140.00 would be crucial. A monthly close significantly below that level would anticipate further weakness for the following quarters, while respecting that line could lead to a rebound.

In conclusion, the trend remains up, but the momentum suggests that the correction has room to go, as long as the pair remains below 150.00.

Summary

The US Dollar has been supported by a strong economy and high yields during most of 2023. However, the trend in yields and the economy has changed, which is weighing on the Greenback and is likely to continue to do so, at least during the first quarter of 2024.

The Yen could receive support from the BoJ if it indicates a shift toward ending its ultra-loose monetary policy stance, potentially through a rate hike that would mark the end of seven years of negative rates. Governor Ueda and Deputy Governor Hino offered some comments about it in December. Rumors and speculations in that direction would trigger momentum for the Yen.

The scenario at the end of 2023 looks set for further weakening in USD/JPY. With market repositioning and a wild US Treasury market, volatility is expected to remain elevated early in 2024, with moves in both directions.

(This story was corrected on December 19 at 13:13 GMT to say that the Bank of Japan could end its negative interest rate policy (NIRP). A previous version of the story said that there was a possibility that the BoJ could end its zero interest rate policy (ZIRP).