AUD/USD Current Price: 0.6832

- US Dollar Index rebounds from monthly lows, rises above 101.00.

- Higher Treasury yields boost the Dollar’s rebound.

- The bullish momentum in AUD/USD is fading, but the overall trend is still upward.

The AUD/USD hit a fresh five-month high at 0.6871 but lost momentum. During the American session, the pair turned negative, falling below 0.6850 amid a recovery of the US Dollar, which was boosted by higher Treasury yields.

Market participants largely ignored the US data releases on Thursday, which showed an increase in Initial Jobless Claims above expectations to 218,000 in the week ended December 23. Another report indicated that Pending Home Sales remained flat in November instead of the expected 1% increase.

On Friday, no data is scheduled from Australia, while the Chicago PMI will be released in the US. Attention is now focused on next week’s US employment data, which includes ADP, JOLTS, jobless claims, and Nonfarm payrolls.

The US Dollar dynamics continue to be the critical driver in AUD/USD. However, current market conditions with low volume could trigger unexpected moves without catalysts. Given these circumstances and wider spreads, there may be reduced incentives to trade towards the end of 2023.

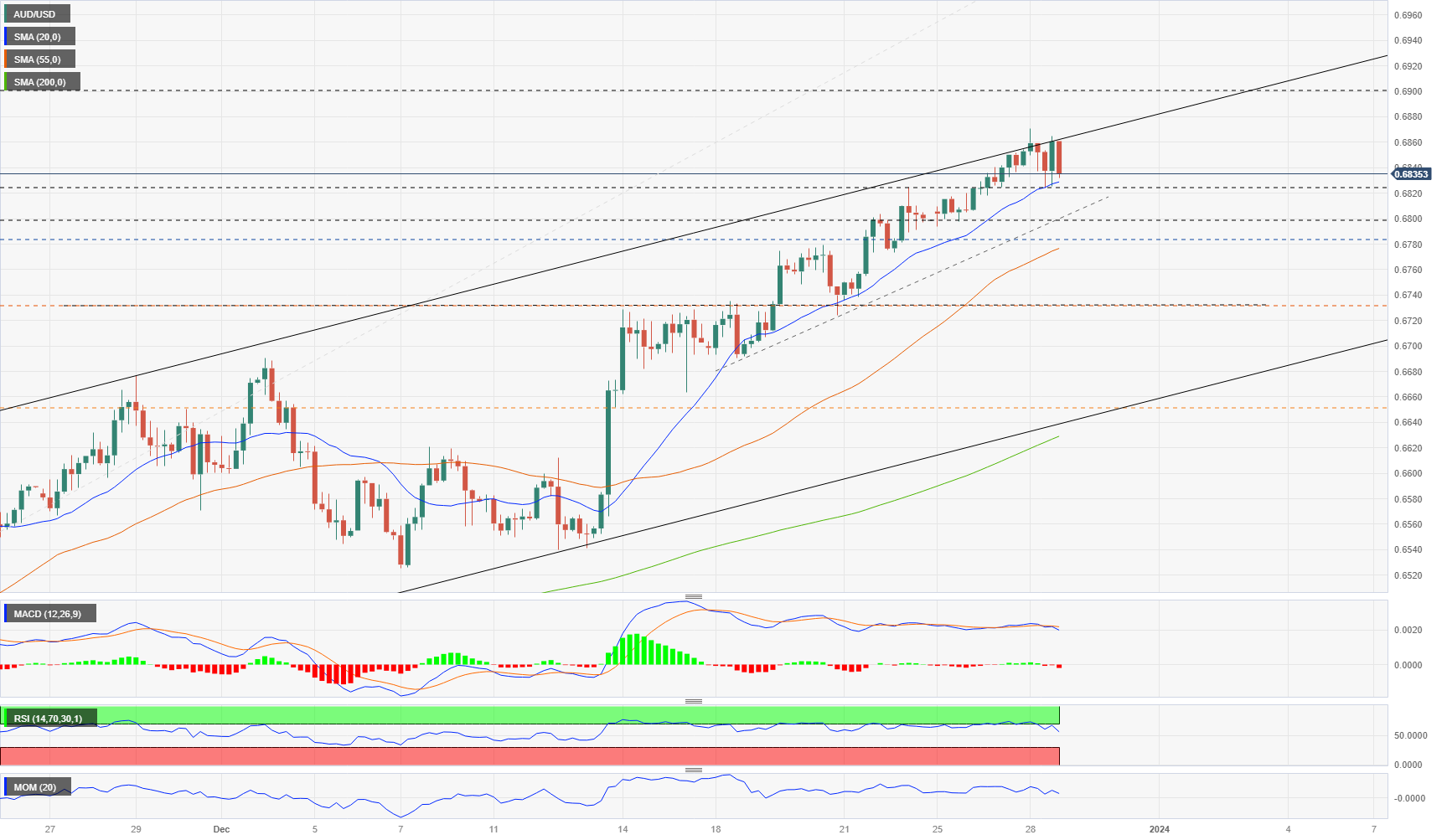

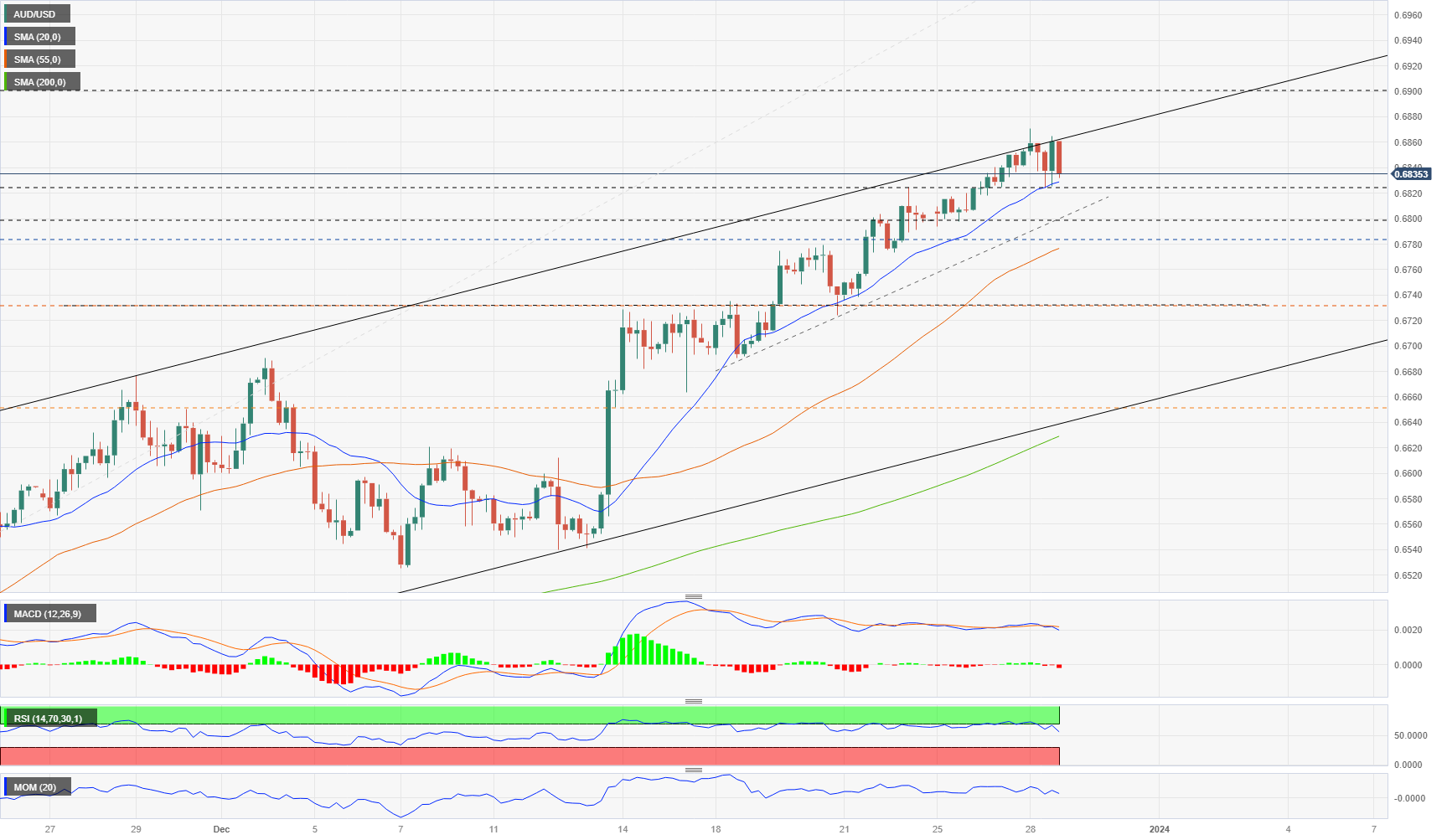

AUD/USD short-term technical outlook

The AUD/USD is trading around the upper limit of an ascending channel, holding a bullish bias but correcting. The pair is about to post its second consecutive monthly gain. On the monthly chart, it has risen above the 20-Simple Moving Average (SMA) for the first time since March 2022, which is a positive sign for the first half of 2024.

Ahead of the Asian session, the 4-hour chart shows that the price is still above the 20-SMA and near the relevant support area at 0.6830. Technical indicators favor further downside, with the Relative Strength Index (RSI) moving south and the MACD showing bearish signs. A break below 0.6830 would open the doors to a deeper correction. If AUD/USD holds above 0.6830, it could continue to consolidate between that level and 0.6865.

Support levels: 0.6830 0.6795 0.6750

Resistance levels: 0.6855 0.6870 0.6905