- Gold staged a late rebound to close the week little changed.

- XAU/USD could stretch higher once $2,060 is confirmed as support.

- December inflation data from the US could trigger the next big action in the pair.

After posting three consecutive weekly gains to end 2023, Gold started the new year on the back foot and lost nearly 1% before erasing its weekly losses late Friday. The short-term outlook for Gold hinges on US inflation data for December, which could influence the Federal Reserve (Fed) interest-rate outlook and trigger a big reaction in XAU/USD next week.

Gold price edged lower to begin 2024

The market action remained subdued on Tuesday as trading conditions started slowly to normalize following the long weekend. As the US Dollar (USD) staged a technical rebound following the dismal performance seen in the last couple of weeks of 2023, XAU/USD closed the day in negative territory.

On Wednesday, the US ISM Manufacturing PMI improved to 47.4 in December from 46.7 in November. Additionally, the number of job openings on the last business day of November stood at 8.79 million, down modestly from 8.85 million in October. Although these data failed to trigger a noticeable market reaction, the USD benefited from risk aversion and caused XAU/USD to continue to push lower. As Wall Street’s main indexes lost about 1% on the day, Gold dropped to its lowest level in nearly two weeks at $2,030.

Private sector employment in the US rose by 164,000 in December and annual pay was up 5.4%, the Automatic Data Processing (ADP) reported on Thursday. The benchmark 10-year US Treasury bond yield climbed above 4% after this data and didn’t allow XAU/USD to stage a meaningful rebound. The probability of the Federal Reserve (Fed) lowering the policy rate by 25 basis points in March declined to 65% on Thursday from 85% earlier in the week following employment-related US data.

The monthly data published by the US Bureau of Labor Statistics showed on Friday that Nonfarm Payrolls (NFP) rose by 216,000 in December, surpassing the market expectation for an increase of 170,000. On a concerning note, the previous two NFP readings were revised lower by a total of 71,000. The Unemployment Rate held steady at 3.7% in the same period, but the Labor Force Participation Rate fell to 62.5% from 62.8% in November. Although the initial reaction provided a boost to the USD, underlying details of the jobs report didn’t allow the currency to preserve its strength. In turn, XAU/USD recovered back above $2,050 after falling below $2,030 with the immediate reaction. Finally, the ISM Services PMI declined to 50.6 in December from 52.7 in November, putting additional weight on the USD’s shoulders.

Gold price could show significant reaction to US inflation data

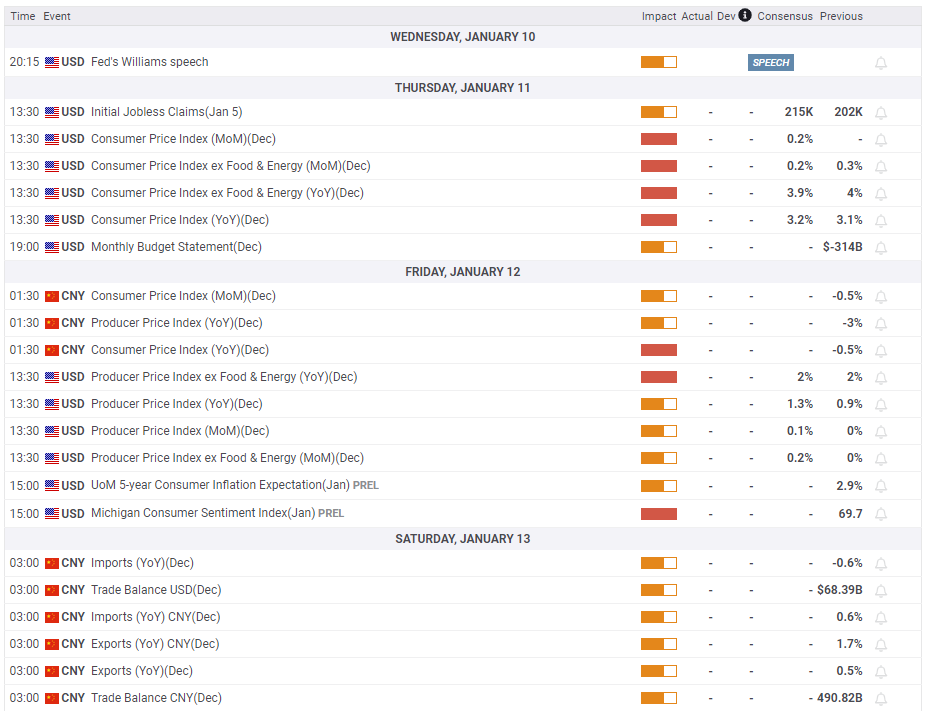

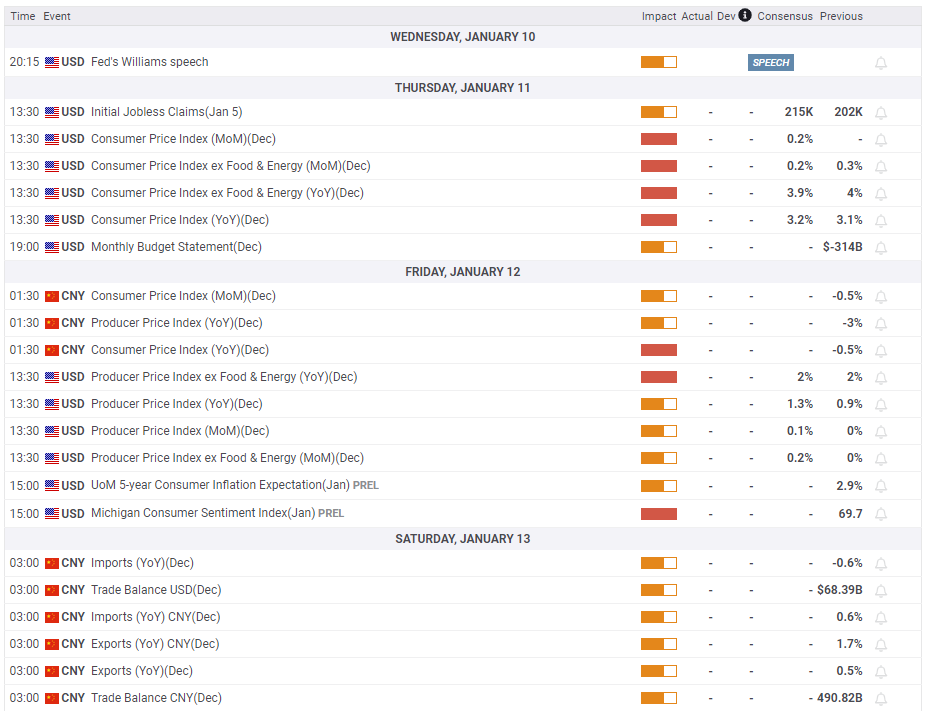

Next week’s economic calendar will not offer any high-tier data releases in the first half of the week. Hence, market participants are likely to assess technical developments for trading opportunities.

On Thursday, the US Bureau of Labor Statistics (BLS) will publish Consumer Price Index (CPI) data for December. The Core CPI, which excludes volatile food and energy prices, is forecast to rise 0.3% on a monthly basis to match November’s increase. A monthly core CPI print of 0.5% or higher could fuel another leg higher in US yields and weigh on XAU/USD. On the other hand, a softer-than-forecast reading could revive expectations for a Fed policy pivot in March.

On Friday, CPI data from China, the world’s biggest demander of Gold, will be watched closely by investors as well. In November, monthly CPI declined by 0.5%. Another negative print could highlight the lack of momentum in consumer spending and hurt Gold.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart advanced to 60 on Friday, pointing out to a bullish tilt in the near-term bias. $2,060 (static level) aligns as a pivot level for XAU/USD. In case the pair starts using that level as support, it could target $2,080 (end-point of the latest uptrend) and $2,100 next.

On the downside, the 20-day Simple Moving Average (SMA) and the ascending trend line coming from early October form a key support level at $2,040. If Gold falls below this level and fails to reclaim it, $2,020-$2,015 (Fibonacci 23.6% retracement level of the latest uptrend, 50-day SMA) and $2,000 (psychological level, static level) could be set as next bearish targets.