- Gold price tests bearish commitments near $2,030 on the renewed upside.

- Further Middle East geopolitical escalation underpins Gold price in the Fed week.

- Gold price rebound could be limited amid daily bearish technical indicators.

Gold price is back in the green early Monday, having posted two straight weekly losses. Gold price is staging a modest rebound, courtesy of the further escalation intensifying in the geopolitical tensions between the Middle East and the United States (US).

Geopolitical risks intensify in the Federal Reserve week

Investors set off the critical week, including the US Federal Reserve (Fed) policy announcements, on a cautious footing after a Reuters report quoted US President Joe Biden and officials stating that three US service members were killed and dozens may be wounded after an unmanned aerial drone attack on US forces stationed in northeastern Jordan near the Syrian border.

Biden said, “while we are still gathering the facts of this attack, we know it was carried out by radical Iran-backed militant groups operating in Syria and Iraq.” “Have no doubt – we will hold all those responsible to account at a time and in a manner of our choosing,” he added.

Markets remain wary of the US response to this escalation by the Iran-backed militia while they keenly await the all-important Fed interest rate decision on Wednesday. Against this backdrop, Gold price jumped but the renewed upside appears in check, as intensifying geopolitical risks boost the safe-haven demand for the US Dollar as well.

Further, the recent series of strong US economic data helped pared back bets for a March Fed rate cut, acting as a headwind for the non-interest rate-bearing Gold price. Markets are currently pricing in about a 48% probability that the Fed will deliver a rate cut in March, down from a 60% chance seen a week ago.

Also, optimism about more stimulus coming in from China faded, as the country’s property market concerns resurfaced. “A Hong Kong court on Monday ordered Evergrande, the world’s most indebted property developer, to liquidate, a ruling that could further dent foreign investor confidence in China,” per the Washington Post (WaPo).

However, Gold price could find continued support if the risk-off market mood intensifies and bumps up the safe-haven flows into the US government bonds, extending the decline in the US Treasury bond yields. The US Dollar could also feel the pain from the falling US Treasury bond yields, with the 10-year benchmark US yields currently losing 0.70% on the day to trade below 4.15%.

The US economic docket is relatively light on Monday, and hence, the geopolitical developments and the pre-Fed positioning could influence the Gold price action.

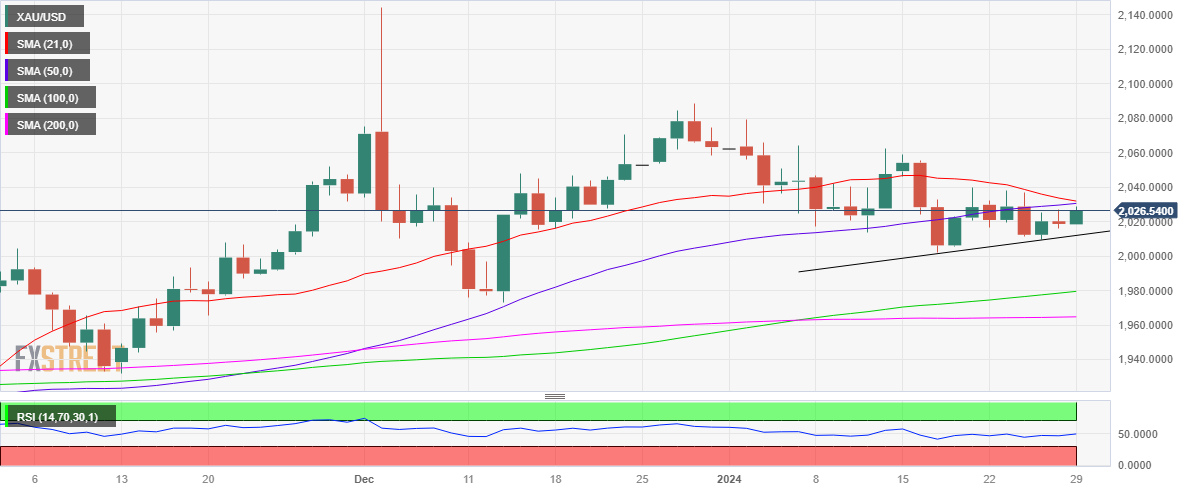

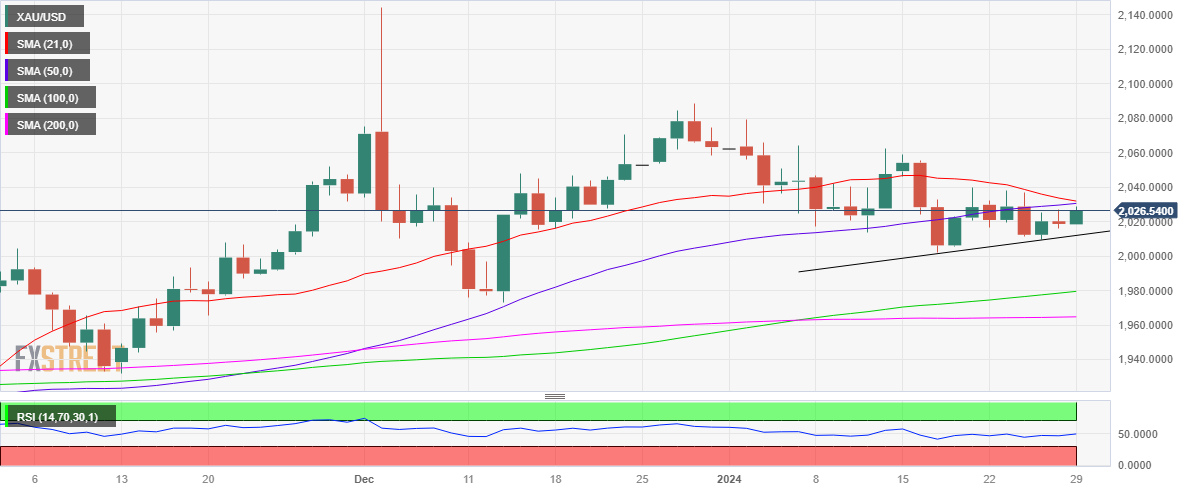

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price is headed to challenge the critical supply zone at $2,030, which is the intersection of the 50-day Simple Moving Average (SMA) and the 21-day SMA.

Gold buyers need a daily candlestick closing above the latter to initiate a meaningful recovery toward the static resistance near the $2,038 level. Further up, the psychological $2,050 level will likely come into play.

With the 14-day Relative Strength Index (RSI) indicator, however, still below the midline, Gold buyers remain cautious.

Additionally, the 21-day SMA is on the verge of crossing the 50-day SMA from above, which if happens will confirm a Bear Cross.

On the downside, an immediate cushion is seen at the rising trendline support of $2,011, below which the $2,000 barrier will be retested.

The next strong downside target is seen around the $1,975 region.