- AUD/USD maintained the range bound trade unchanged.

- Disinflationary pressures gathered pace in the last part of 2023.

- The Federal Reserve left its monetary conditions intact, as expected.

Once again, AUD/USD demonstrated volatile performance on Wednesday, remaining trapped in a side-lined theme that has persisted since the middle of this month. Following an initially auspicious start to the week, the Aussie dollar charted slight gains on a daily basis, always around the 0.6600 neighbourhood and aligning with the marked losses observed in the greenback.

Meanwhile, the resilience of the Australian currency is noteworthy, especially given recent reports indicating potential additional stimulus measures by the PBoC to support China’s stock market and foster economic recovery post-pandemic. Speaking about China, slightly positive results from the Manufacturing and Non-Manufacturing PMIs tracked by NBS for the month of January seem to have lent some legs to AUD, limiting the downside potential at the same time.

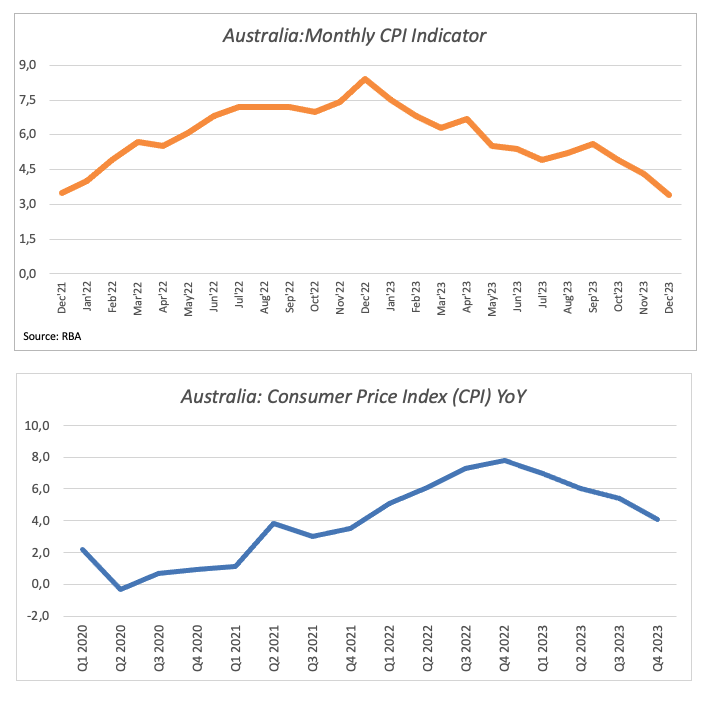

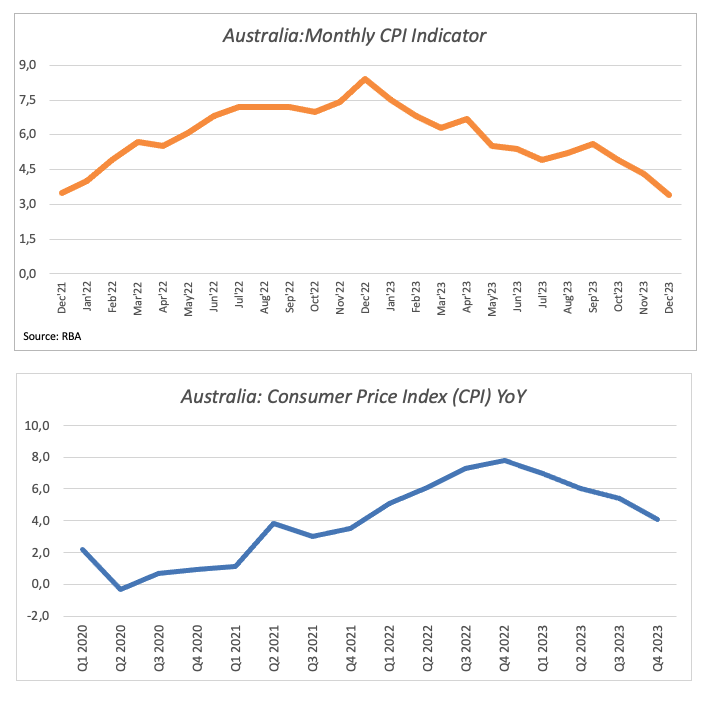

On another front, the anticipated decision of the Reserve Bank of Australia (RBA) to maintain its current policy stance at its February 6 meeting is seen as a factor restricting the potential upward movement of the pair in the near term, likely leading to subdued trading in the short-term future. Underpinning this prospect, the latest inflation data in Australia showed that disinflationary pressures gathered extra steam towards the end of last year; both the Inflation Rate and the RBA’s Monthly CPI Indicator rose (much) less than initially estimated by 4.1% in Q4 and by 3.4% in December, respectively.

Collaborating with the pair’s price action also emerged the key FOMC event, where the Federal Reserve matched the broad consensus and left its interest rates intact early on Wednesday. The greenback gathered pace and kept the downside pressure on the Aussie dollar after the Committee showed no rush to reduce its rates, as it needs further evidence that inflation is heading towards the bank’s goal, at the time when Chair Powell almost ruled out an interest rate cut in March.

A glimpse at the Australian docket notes that preliminary readings for Building Permits for the month of December are only due on Thursday.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further losses may cause the AUD/USD to retest its 2024 low of 0.6524 (January 17), which appears reinforced by the provisional 100-day SMA (0.6528) and by the December 2023 bottom. Extra weakness from here could put a probable visit to the 2023 low of 0.6270 (October 26) back on the radar ahead of the round level of 0.6200, all of which precede the 2022 low of 0.6169 (October 13). On the contrary, there is a temporary barrier at the 55-day SMA of 0.6644. The breakout of this zone may motivate the pair to set sails for the December 2023 high of 0.6871 (December 28), ahead of the July 2023 top of 0.6894 (July 14) and the June 2023 peak of 0.6899 (June 16), all preceding the key 0.7000 yardstick.

No changes to the consolidative phase are seen on the 4-hour chart. On the bullish side, there is an immediate hurdle at 0.6624 ahead of the 200-SMA at 0.6684. The surpassing of this zone indicates a potential advance to 0.6728. On the flip side, there is initial support around 0.6551 before 0.6525. If this zone is breached, there is no significant dispute until 0.6452. The MACD remains flat around the positive line, and the RSI leaps past 52.

View Live Chart for the AUD/USD