The first full week of February will deliver a quieter tone compared to last week.

Monday’s ISM Services PMI for January is the main macro driver in focus for the US, while in Asia Pac, the Reserve Bank of Australia’s (RBA) rate decision takes to the front on Tuesday.

Forget about March

Last week’s stage was set exclusively for the Fed, and the primary message was to forget March. While the FOMC left the target rate unchanged at 5.25%-5.50%, it opened the door to rate cuts but the Fed Chairman Jerome Powell almost explicitly pushed back against March’s policy meeting, in line with Futures market pricing (24% probability priced in as of writing). Meanwhile, we have also seen a rate repricing for May’s policy meeting following Friday’s NFP beat, effectively nudging things in favour of a 25bp cut out to June (44bps) rather than May (22bps).

Traders also welcomed a slew of US jobs data last week, including increased Job Openings (increased to a little more than 9 million in December 2023; however, with the upward revision of the previous number to 8.93 million, there was little change), weak ADP employment growth (107,000), as well as a -0.4-percentage point drop in the ISM Manufacturing PMI employment component from 47.5 to 47.1 and weekly jobless filings jumping to 224k from a slightly upwardly revised 215k print. On top of this, Friday witnessed a monster beat on the non-farm payrolls release; the US economy added 353,000 new jobs in January, surpassing all estimates and breezing through the 216,000 jump in December. The unemployment rate remained unchanged at 3.7%, and the year-on-year earnings surged to 4.5% (M/M rose 0.6%), smashing through all estimates and the prior (4.1%).

Needless to say, it was a busy one for US labour data, with Friday’s bumper NFP essentially helping seal the deal for a ‘no cut’ in March and feeding into the US economy’s exceptionalism. This also presents a problem for the Fed to move on rates in H1, particularly given the strength of wage growth.

Week ahead

This week’s ISM Services PMI print will essentially be the highlight event for the US, gracing the airwaves at 3:00 pm GMT. The market’s median estimate is for an increase to 52.0, up from 50.6 in December 2023 (the estimate range is between 53.0 and 50.6). You may recall that the previous ISM Services release for December revealed narrowing growth, from 52.7 in November to 50.6. An important point to note from the previous release was the meaningful drop into contractionary territory for the ISM Services employment index from 50.7 to an eye-popping 43.3. Consequently, this will be a closely watched number this week. Consider digging into our week-ahead post for the Dollar Index, which is technically demonstrating scope for further outperformance.

As for the RBA, no fireworks are expected here. The central bank, scheduled for 3:30 am GMT, is widely expected to hold its Cash Rate unchanged at 4.35% on 6 February for a second consecutive meeting (a 12-year high). According to the ASX 30-Day Interbank Cash Rate Futures, we’re pretty much fully priced in for a no-change as of writing (95% probability). Alongside the rate decision, traders will receive the Rate Statement, the quarterly Statement of Monetary Policy (SoMP), which offers the central bank’s view on economic conditions, together with an outlook on inflation and growth, as well as the Press Conference held by RBA Governor Michelle Bullock an hour after the rate decision. Therefore, there will be plenty of fresh data for traders to get their teeth into here. The AUD/USD was hammered lower on Friday, launching the currency pair to within a stone’s throw from daily support. According to technical studies, further selling is possible this week.

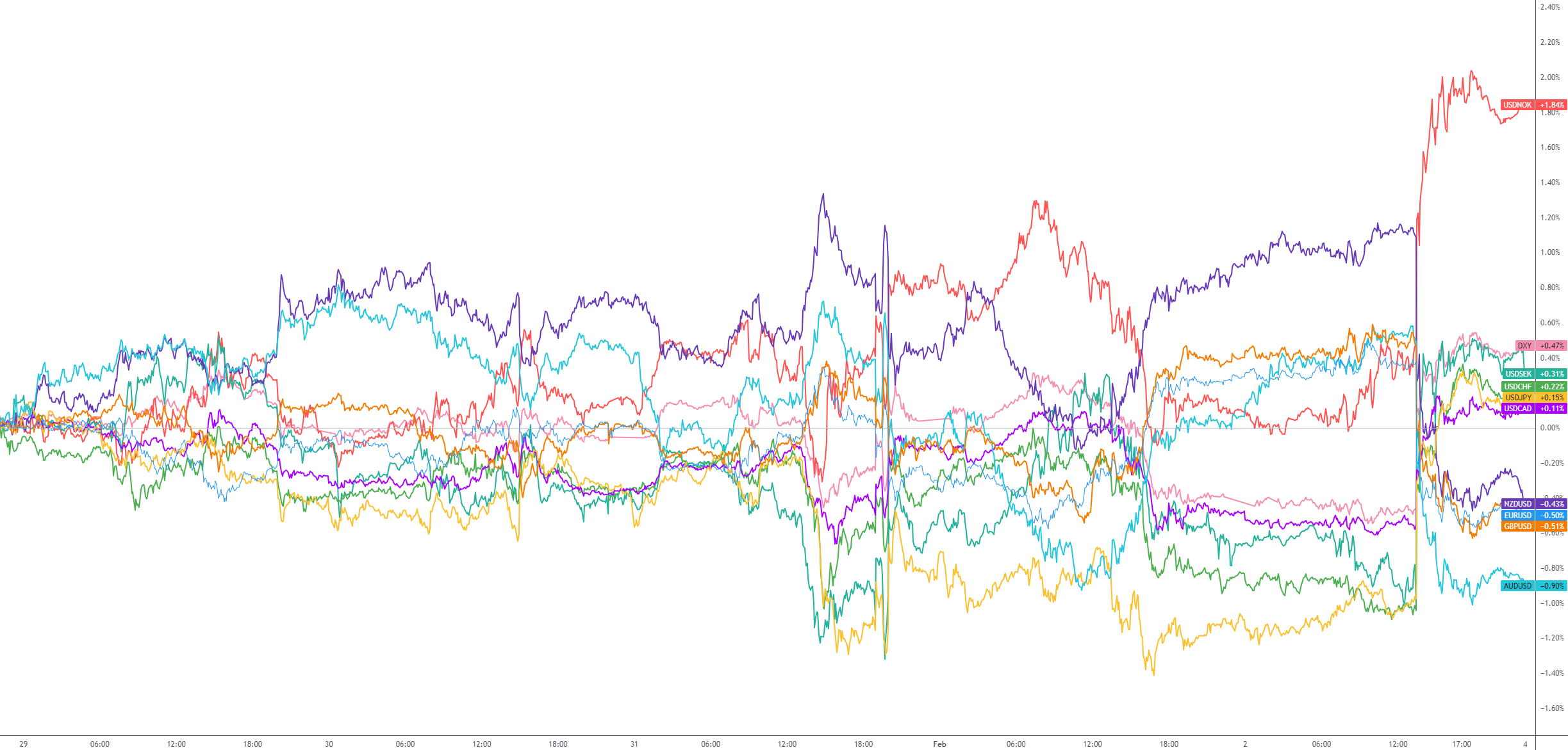

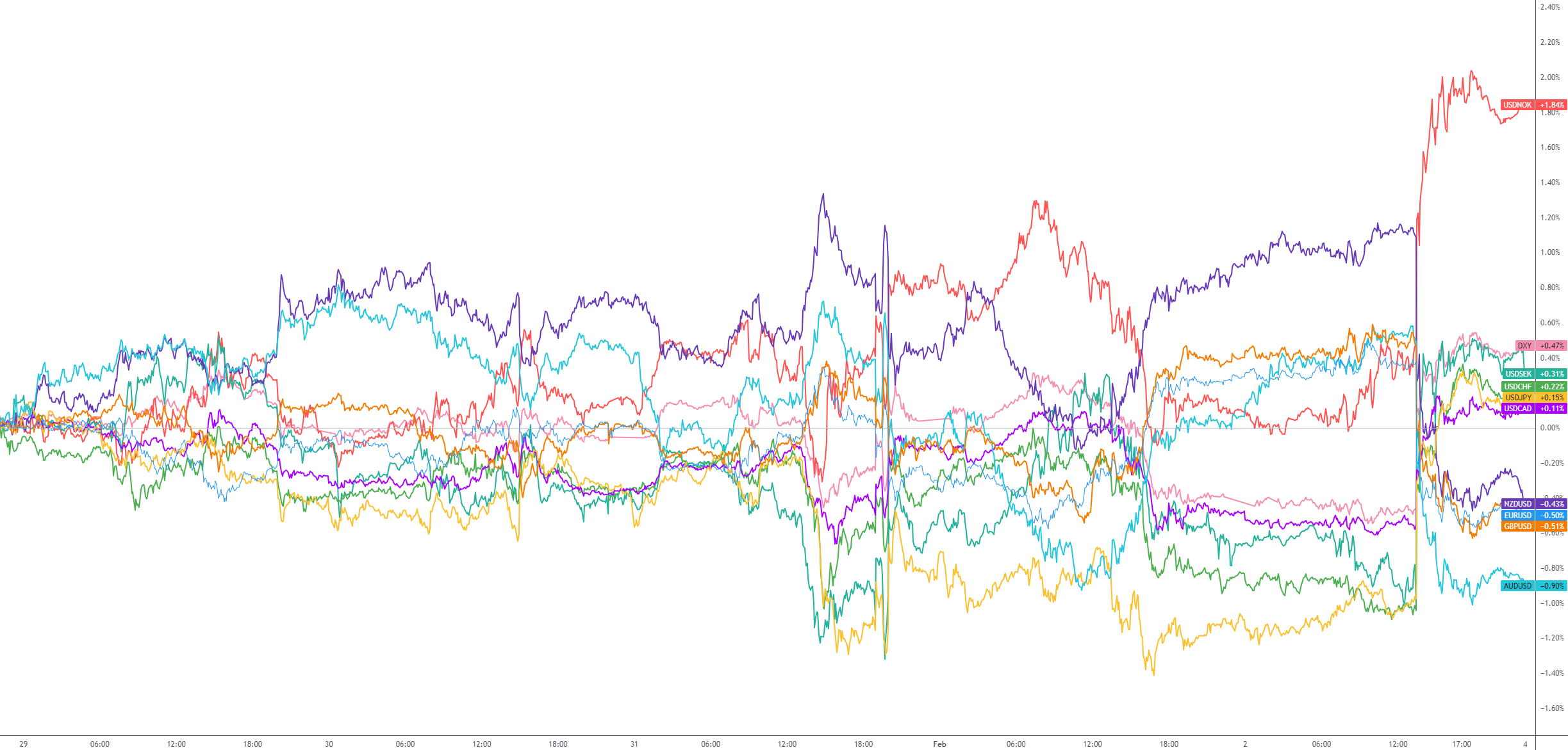

G10 FX (5-day change):

Source: TradingView