Markets

Without significant macroeconomic developments, investors have shifted their focus to micro-level dynamics, particularly in the technology sector. Big tech companies have exerted downward pressure on the stock market overnight, lugging it away from its recent all-time highs.

Amid this backdrop, the tech-heavy Nasdaq Composite experienced the most significant decline, dropping nearly 1% in value. The broader market also saw losses, with the S&P 500 falling approximately 0.6% and the Dow Jones Industrial Average decreasing roughly 0.2%. These declines come after a rocky week on the macro front, in which all three major indices closed lower amid doubts about the odds of a “soft landing” after a hotter-than-inflation gut punch knocked investors slightly off their bullish bias.

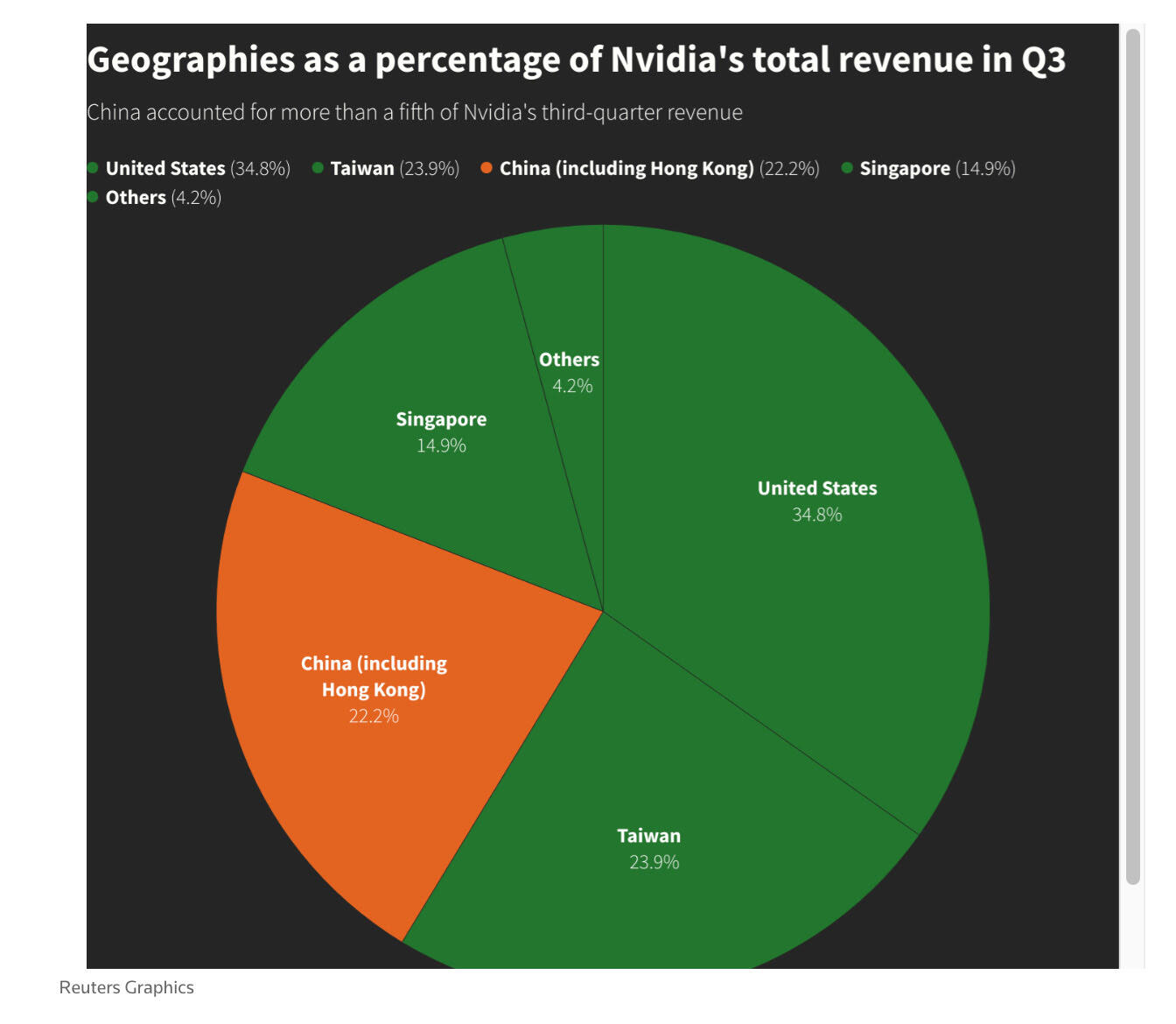

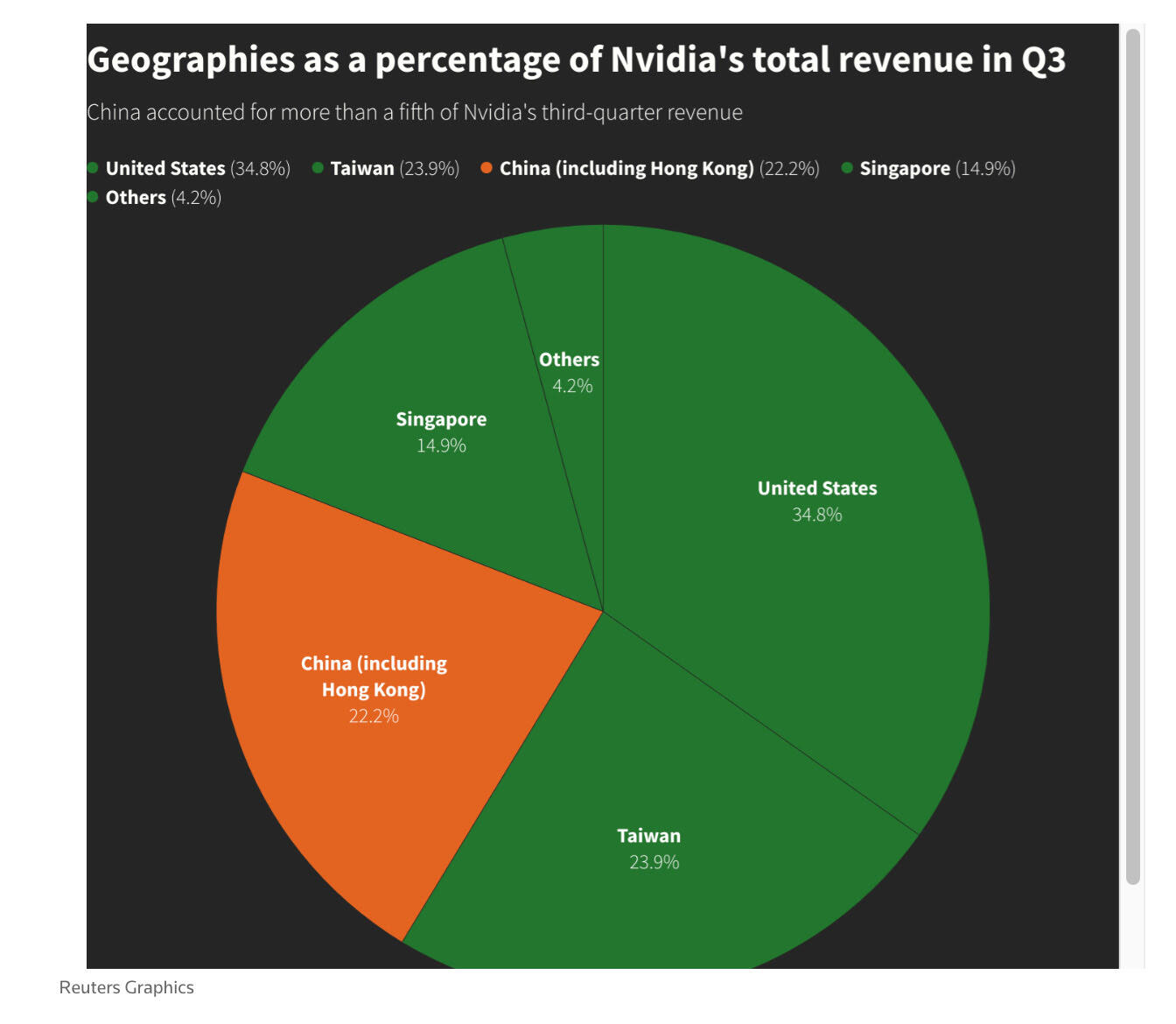

Investors closely monitored earnings as markets resumed trading in full swing after the Presidents’ Day Break. Still, Wall Street is laser-focused on those from Nvidia (NVDA) scheduled for Wednesday. The market views Nvidia’s earnings as the artificial intelligence ( AI )bellwether. Given its significance as the third-largest company by market value and its focus on AI, it could be seen as a trend-setting short-term turning point. With only a few mega-cap stocks driving most of the recent gains in the market, any potential shortfall in Nvidia’s earnings, especially amid high expectations, could trigger a broader pullback in stocks.

With the Mag 7 influence over broader market trends, their earnings reports have taken on a high-risk event status, akin to top-tier macro events. So, in a sense, we should not be surprised by the -4 % drop in Nvidia’s shares overnight as investors take some “chips” ( pardon the pun) off the table to mitigate risk in an adverse market reaction.

But unlike macro events, where market reactions often follow a binary pattern, earnings reports present a more nuanced challenge. Even if an earnings report hits the mark precisely, predicting the market’s reaction remains uncertain. The first question investors will ask is, are the earnings good enough? Given the high valuation and the current muddled US macro scrim, answering that question too quickly can lead to a psychological impulse to sell the news rather than buy the facts.

Essentially, the narrative remains consistent each quarter for mega-cap companies, barring a few turbulent reports in 2022. Generally, their financial numbers continue to meet or exceed expectations. These corporate giants have become ingrained in the fabric of life for consumers and business people across developed and developing nations, symbolizing a significant portion of daily existence. While there may be occasional dips in performance, very few quarters can be classified as objectively harmful. The perception of a “bad” quarter often depends on relative or subjective measures rather than absolute balance sheet shortcomings.

Oil markets

The oil market experienced a modest selloff at the beginning of the holiday-shortened week as traders sifted through conflicting demand signals from major global economies. During its Lunar New Year holidays, China witnessed a significant surge in domestic travel and spending, surpassing pre-pandemic levels for the first time since 2020. However, on Tuesday, China’s central bank announced a rate cut to revitalize a struggling property sector that failed to ignite enthusiasm in oil markets.

But the pushback on the bullish thesis is stagflation concerns in the US. Investors continued to digest mixed macroeconomic data for January. Both consumer and producer inflation unexpectedly accelerated, while retail sales sharply declined.