AUD/USD Current Price: 0.6606

- The Reserve Bank of Australia is expected to leave interest rates unchanged.

- The sharp reversal of the US Dollar leaves AUD/USD vulnerable in the short term.

- Price is testing an upward trendline near 0.6600.

The AUD/USD reached its highest level in four months at 0.6689 and then sharply reversed, falling towards 0.6600. The decline occurred without a clear catalyst and followed a reversal in Gold and Silver and a stronger US Dollar. The focus is now on the Reserve Bank of Australia (RBA) meeting, followed by key US data.

The RBA is expected to leave its key interest rate unchanged at 4.35% after the November rate hike. Data since the last meeting has been mixed, with a strong labor market and slower inflation. The latest report warrants some caution from the RBA, that is unlikely to bring a dovish surprise, particularly after Governor Michele Bullock’s comments last week regarding stronger-than-anticipated inflation pressures.

The outcome of the RBA meeting is not expected to significantly impact the Australian Dollar, as there are not many changes anticipated in the statement compared to the previous meeting. The central bank will likely need more data, such as Q4 inflation, to reassess its monetary policy stance. Australia will report Q3 GDP on Wednesday, followed by trade data on Thursday.

The US Dollar started the week under pressure, extending the negative momentum from Friday, but on Monday staged a recovery that appears to be a reversal. Economic data, particularly concerning the labor market, could fuel the Dollar’s momentum or push it back towards monthly lows. Data due from the US on Tuesday includes the JOLTS report and the ISM Services PMI. Economic data will mostly revolve around the labor market, but it is unlikely to change expectations that the Federal Reserve is done raising interest rates, and forecasts suggest a more balanced labor market.

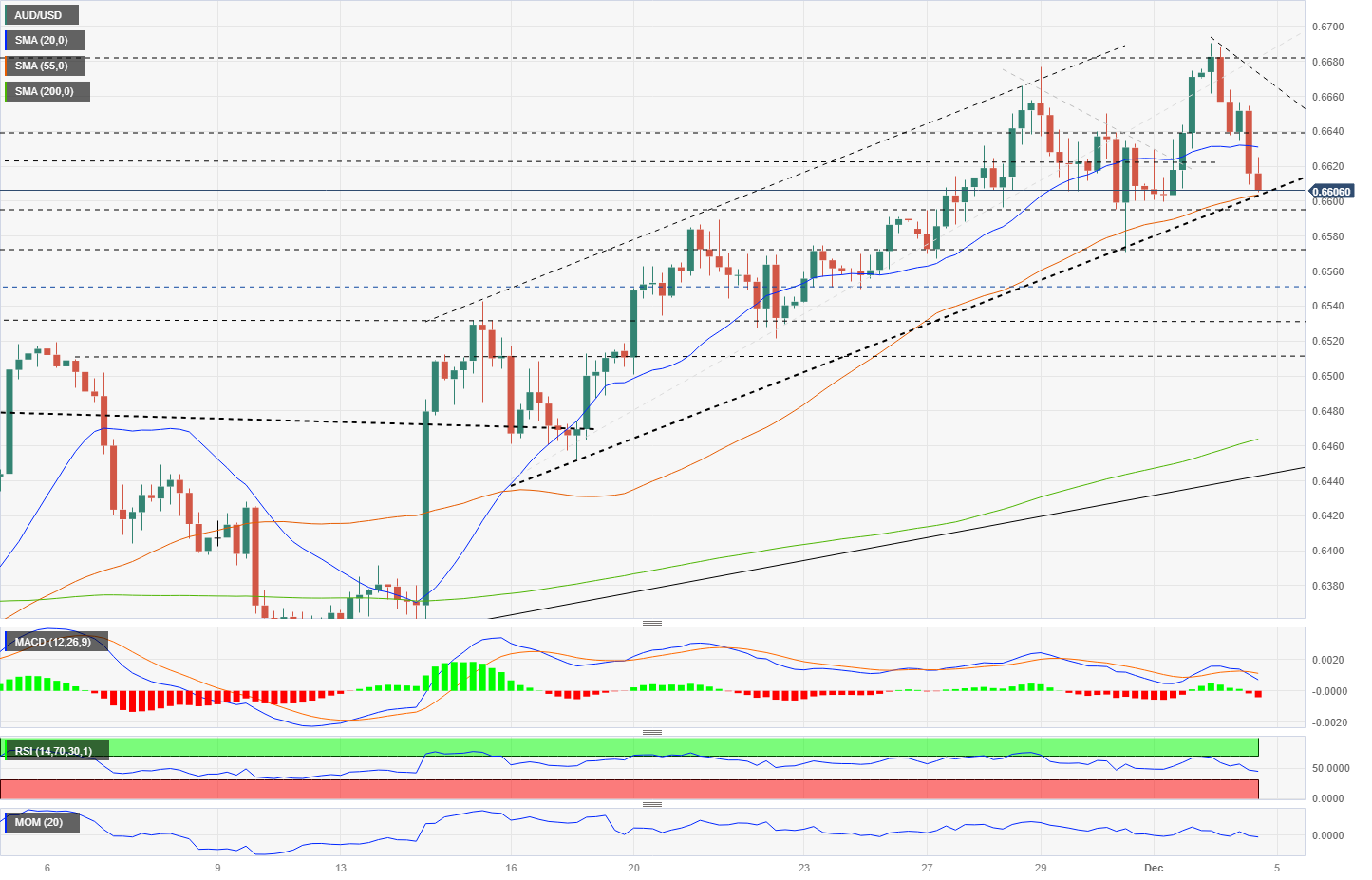

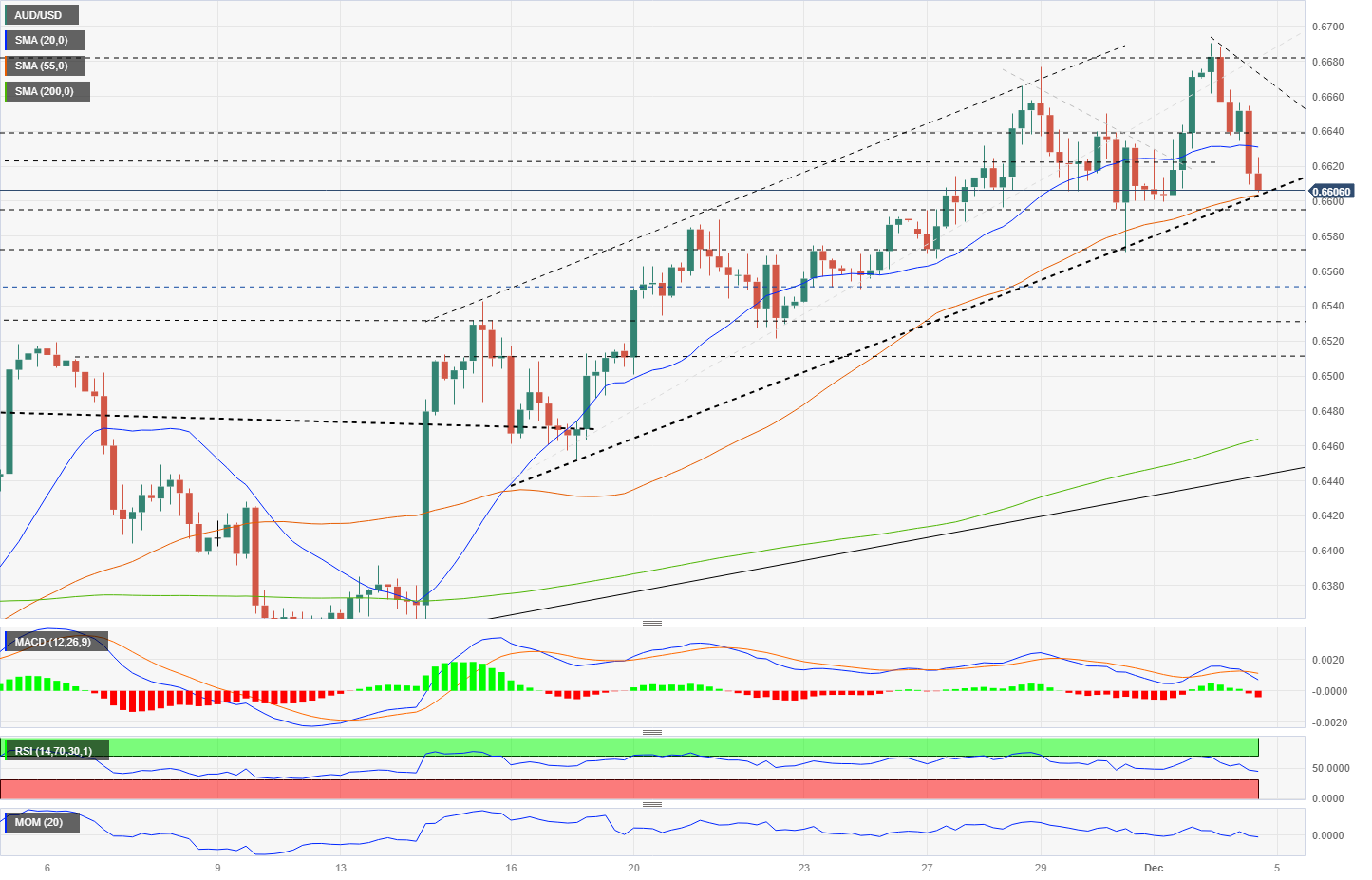

AUD/USD short-term technical outlook

The retreat from near 0.6700 keeps the price within a wide range, between the 200-day Simple Moving Average (SMA) at 0.6580 and 0.6680. The bias is up on the daily chart, and the price holds well above key SMAs. However, the indicators point to potential weakness ahead, with the Relative Strength Index (RSI) moving south and the Momentum approaching the midlines.

On the 4-hour chart, AUD/USD remains within an upward channel, finding support around 0.6600. A break below 0.6595 should trigger further weakness. Technical indicators are biased to the downside, including MACD, RSI below 50, and Momentum below midlines. A recovery above 0.6630 (20-SMA) ahead of the Asian session would alleviate the bearish pressure. The key resistance stands at 0.6660.

Support levels: 0.6600 0.6570 0.6530

Resistance levels: 0.6635 0.6660 0.6690

View Live Chart for the AUD/USD