- Gold climbed to a fresh one-month high above $2,050 this week.

- The technical outlook points to a slightly bullish tilt in the near term.

- February labor market data from the US could trigger a big reaction in XAU/USD.

Gold (XAU/USD) gathered bullish momentum and reached its highest level since early February above $2,050 on Friday after spending the first half of the week consolidating in a tight channel. The near-term technical outlook for XAU/USD offers encouraging signs for buyers, but investors could ignore technical readings when reacting to February labor market data from the US next week.

Gold price rose as US yields edged lower

In the absence of high-tier macroeconomic data releases, the action in financial markets remained subdued at the beginning of the week and Gold closed the first two trading days with minor changes. The data from the US showed on Tuesday that Durable Goods Orders declined by 6.1% on a monthly basis, but this reading failed to trigger a noticeable reaction.

On Wednesday, the US Bureau of Economic Analysis (BEA) announced that it revised the annualized Gross Domestic Product (GDP) growth to 3.2% from 3.3% in the initial estimate. The US Dollar (USD) came under modest selling pressure during the American trading hours and allowed XAU/USD to end the day in positive territory.

Gold gathered bullish momentum on Thursday, when it touched its highest level in nearly a month at $2,050.

Inflation in the US, as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, declined to 2.4% on a yearly basis in January, the BEA reported. This reading followed the 2.6% increase recorded in December and came in line with the market expectation. The Core PCE Price Index, the Federal Reserve’s preferred gauge of inflation, rose 0.4% on a monthly basis, also matching analysts’ estimates. The benchmark 10-year US Treasury bond yield declined below 4.3% with the immediate reaction to PCE inflation data and helped XAU/USD push higher.

Some cautious remarks from Fed officials on the policy outlook, however, helped the USD hold its ground and limited Gold’s upside ahead of the weekend. Atlanta Fed President Raphael Bostic noted that it might be appropriate to start reducing rates in summer, San Francisco Fed President Mary Daly argued that cutting rates too quickly could cause inflation to get stuck, and Cleveland Fed President Loretta Mester said that they can’t expect last year’s disinflation to continue.

On Friday, Gold renewed its monthly high above $2,050 the US Treasury bond yields edged lower during the European trading hours.

Gold price could extend uptrend on a soft US jobs report

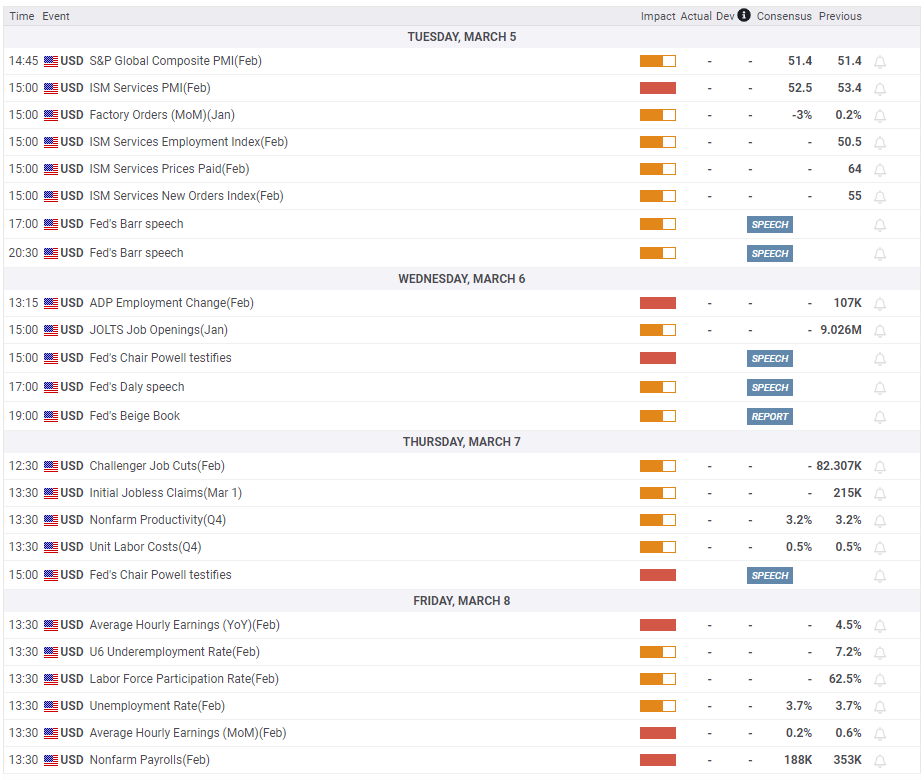

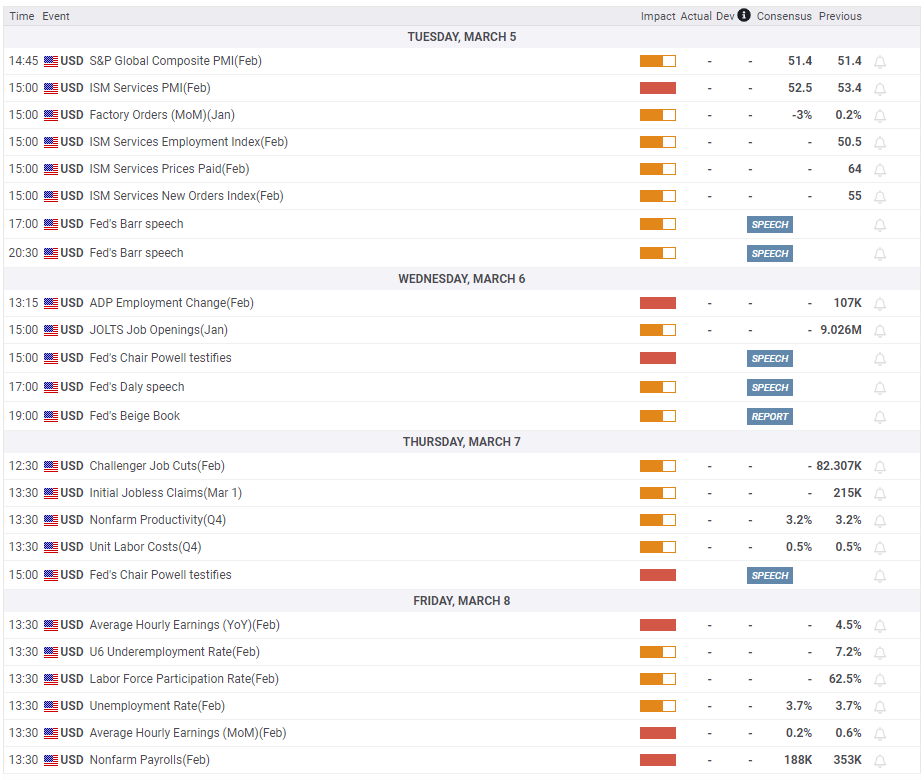

On Tuesday, the ISM Services PMI will be featured in the US economic docket. The headline PMI is forecast to hold above 50 in February and highlight an ongoing expansion in the service sector’s business activity. In January, the Prices Paid Index of the PMI survey jumped to 64 from 56.7 in December, showing an acceleration in the input cost inflation. A similar increase in the inflation component in February could provide a boost to the USD and weigh on XAU/USD with the immediate reaction.

The ADP Employment Change for February and January JOLTS Job Openings, to be released on Wednesday, will be the first employment-related data releases of the week. In January, private sector payrolls rose 107,000. A reading below 100,000 in ADP Employment Change could point to looser conditions in the labor market and weigh on the USD. As for the JOLTS report, the number of job openings has been fluctuating at around 9 million since October. Unless there is a significant change in this data, investors are likely to refrain from reacting ahead of Friday’s February jobs report.

In January, Nonfarm Payrolls surged by 353,000 and reaffirmed another pause in the Fed’s policy rate in March. Strong Consumer Price Index and Producer Price Index readings for January, combined with the impressive labor market data, revived expectations for a further delay in the policy pivot. According to the CME FedWatch Tool, markets price in a 24% probability of a 25 basis points Fed rate cut in May and see a nearly 75% chance that the Fed will reduce the policy rate in June after staying on hold in March and May.

A sharp drop in Nonfarm Payrolls growth, a reading below 150,000, could cause investors to reassess the possibility of a rate cut in May and trigger a sell-off in the USD with the immediate reaction. On the other hand, a print near 200,000 could be enough to reassure markets that the labor market is healthy enough for the Fed to delay the policy pivot until June. The market positioning suggests that the USD has some more room on the upside in this scenario.

Fed Chairman Jerome Powell will present the Semiannual Monetary Policy Report next week. Powell will testify before the House Financial Services Committee and Senate Committee on Banking, Housing, and Urban Affairs on Wednesday and Thursday, respectively.

Gold technical outlook

Gold closed comfortably above the 50-day Simple Moving Average (SMA), currently located at $2,035, on Thursday after failing to clear that level earlier in the week. Additionally, the Relative Strength Index (RSI) indicator on the daily chart climbed to 60 for the first time since early February, reflecting a buildup of bullish momentum.

On the upside, $2,060 (static level) aligns as interim resistance ahead of $2,080 (end-point of the October – December uptrend) and $2,100 (psychological level). In case XAU/USD returns below $2,035 (50-day SMA), $2,020 (100-day SMA, Fibonacci 23.6% retracement) could be seen as important support levels before sellers could target $2,000 (psychological level, static level).