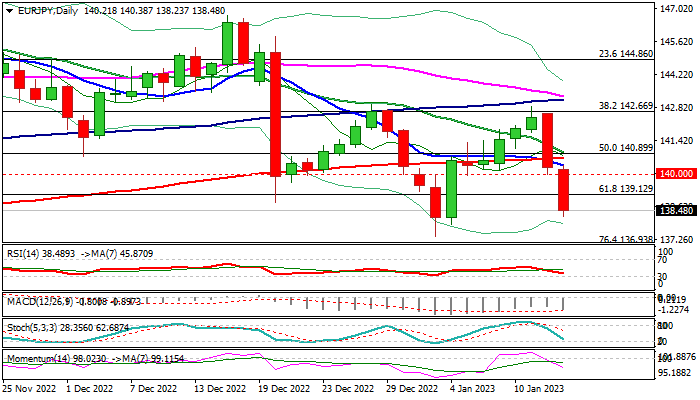

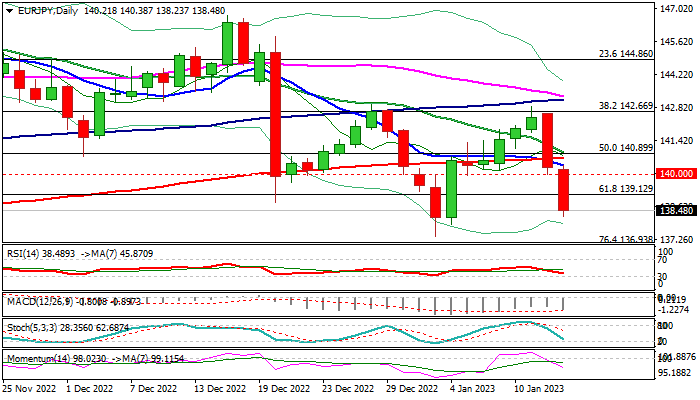

EUR/JPY

The cross extends steep fall into second straight day, losing 1.3% until early US session on Friday, following 1.6% drop on Thursday, as yen rose sharply on weaker dollar and speculations that BoJ is about to start revisions of its ultra-loose monetary policy.

Strong bearish acceleration broke through pivotal support at 140.00 (psychological) and 139.12 (Fibo 61.8% of 133.39/148.40 rally), retracing the most of 137.38/142.85 corrective leg and signaling that larger bears are tightening grip for possible continuation after limited corrective phase.

Formation of 10/200DMA death-cross contributes to negative outlook, as bearish momentum is strengthening on daily chart and RSI and Stochastic indicators are heading south.

Firm break of 137.33/38 pivots (Sep 26/Jan 3 lows) would signal continuation of the downtrend from 148.40 (2022 high).

Upticks under broken 140 support, reverted to solid resistance, should offer better selling opportunities.

Res: 139.12; 140.00; 140.37; 140.68.

Sup: 137.91; 137.38; 136.93; 135.51.