- Gold closed the second straight week in positive territory.

- Falling US T-bond yields helped XAUUSD gather bullish momentum.

- Additional gains are likely in case buyers clear $1,780 resistance.

Following a consolidation phase above $1,700 at the beginning of the week, gold gathered bullish momentum and climbed to its highest level since early July above $1,760. Although the yellow metal lost its bullish momentum on Friday, it managed to close the second straight week in positive territory. The near-term technical outlook points to a bullish tilt and XAUUSD looks to extend its recovery ahead of the July jobs report from the US.

What happened last week?

The data from the US fueled recession fears earlier in the week but investors refrained from taking large positions ahead of the US Federal Reserve’s policy announcements. The headline General Business Activity Index of the Federal Reserve Bank of Dallas’ Texas Manufacturing Outlook Survey dropped to -22.6 in July from -17.7 in June.

On Tuesday, the Conference Board (CB) reported that the Consumer Confidence Index declined to 95.7 from 98.4 in June. “Inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months,” the CB noted in its publication.

The US Census Bureau announced on Wednesday that Durable Goods Orders rose by 1.9% on a monthly basis in June, coming in much better than the market expectation for a decrease of 0.4%. On a negative note, Pending Home Sales fell by 8.6% in the same period, compared to analysts’ forecast for a decline of 1.5%.

The Fed hiked its policy rate by 75 basis points (bps) to the range of 2.25-2.5% following the July policy meeting as expected. During the press conference, FOMC Chairman Jerome Powell said that they will not be providing any rate guidance from now on. “Our thinking is that we want to get to a moderately restrictive level by end of this year,” Powell noted. “That means 3% to 3.5%.” These comments triggered a dollar sell-off and weighed heavily on US Treasury bond yields, providing a boost to XAUUSD mid-week.

Following the Fed event, the probability of a 75 bps rate hike in July dropped to 20% from nearly 50% in the previous week. Additionally, the US Bureau of Economic Analysis’ (BEA) advanced estimate revealed that the US economy contracted at an annualized pace of 0.9% in the second quarter, missing the market forecast for an expansion of 0.5% by a wide margin. The benchmark 10-year US T-bond yield lost nearly 5% in the second half of the day as investors continued to scale down hawkish Fed bets.

The BEA's monthly publication showed on Friday that inflation in the US, as measured by the Personal Consumption Expenditures (PCE) Price Index, climbed to 6.8% on a yearly basis in June from 6.3% in May. The Core PCE Price Index, the Fed's preferred gauge of inflation, rose to 4.8% from 4.7% in the same period. The dollar staged a rebound on hot inflation data and capped gold's upside ahead of the weekend.

Next week

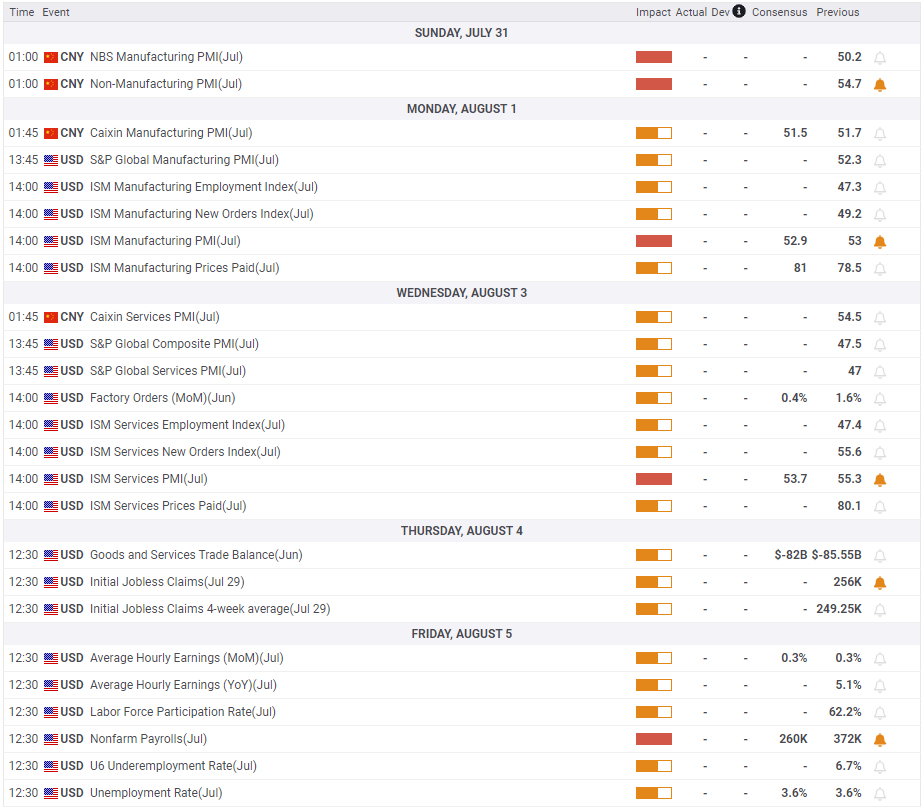

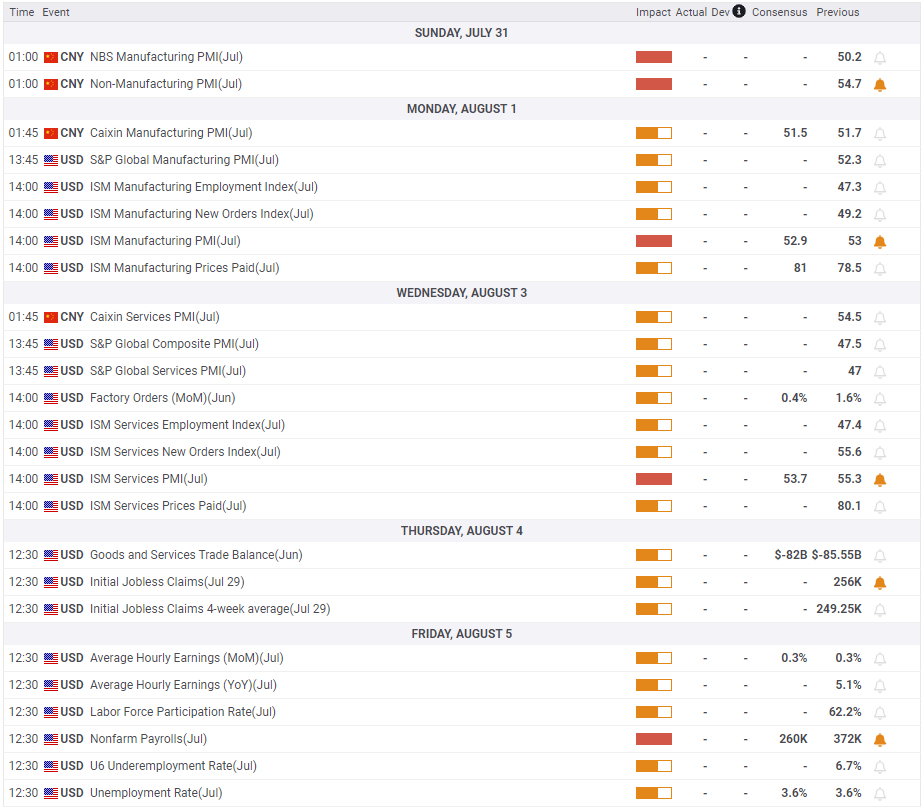

On Monday, the ISM Manufacturing PMI data from the US will be watched closely by market participants. In case this print arrives below 50, the USD is likely to have a difficult time finding demand. On the other hand, an upbeat reading by itself might not be enough for investors to reassess the Fed’s rate outlook. The ISM will also release the Services PMI report on Wednesday. The S&P Global’s Services PMI fell to 47 in July’s flash estimate from 52.7 in June, pointing to a contraction in the service sector’s business activity. The dollar weakened against its major rivals after this data and a similar market reaction could be witnessed if the ISM’s Services PMI falls into the contraction territory.

Finally, the US Bureau of Labor Statistics will publish the July jobs report on Friday. Nonfarm Payrolls (NFP) are expected to rise by 260,000 following June’s better-than-forecast increase of 372,000. The Unemployment Rate is seen to remain steady at 3.6%.

When commenting on the labor market, Powell said that it was extremely tight and said that the job growth was still robust. “Overall labor market suggests underlying aggregate demand remains solid,” the Chairman added. Although the US central bank acknowledges the slowdown in economic activity, it remains committed to fighting inflation as long as the job market remains healthy. Hence, the market reaction should be pretty straightforward with an upbeat NFP print providing a boost to the dollar and vice versa.

Investors will also pay close attention to Fed officials’ comments throughout the week. The fact that there is still a 20% probability of a 75 bps rate hike suggests that the dollar has more room on the downside if markets end up fully pricing in a 50 bps rate increase in September. In that scenario, gold should be able to preserve its bullish momentum.

In case Fed officials leave the door open for a 75 bps hike in September on a robust jobs report, XAUUSD should have a tough time extending its rebound.

It’s also worth noting that the 10-year US T-bond yield stays near the key 2.7% level. If that level turns into resistance, another leg lower in yields could help gold stretch higher.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart climbed above 50 and XAUUSD closed the last two trading days above the 20-day SMA, pointing to a bullish tilt in the near-term technical outlook. On the upside, $1,780 (Fibonacci 23.6% retracement of the latest downtrend, the descending trend line) aligns as initial resistance. In case buyers manage to flip that level into support, $1,800 (psychological level 50-day SMA) and $1,830 (Fibonacci 38.2% retracement) could be seen as the next bullish targets.

On the downside, $1,740 (20-day SMA) forms first support before $1,700 (psychological level) and $1,680 (July 21 low, static level from March 2021).

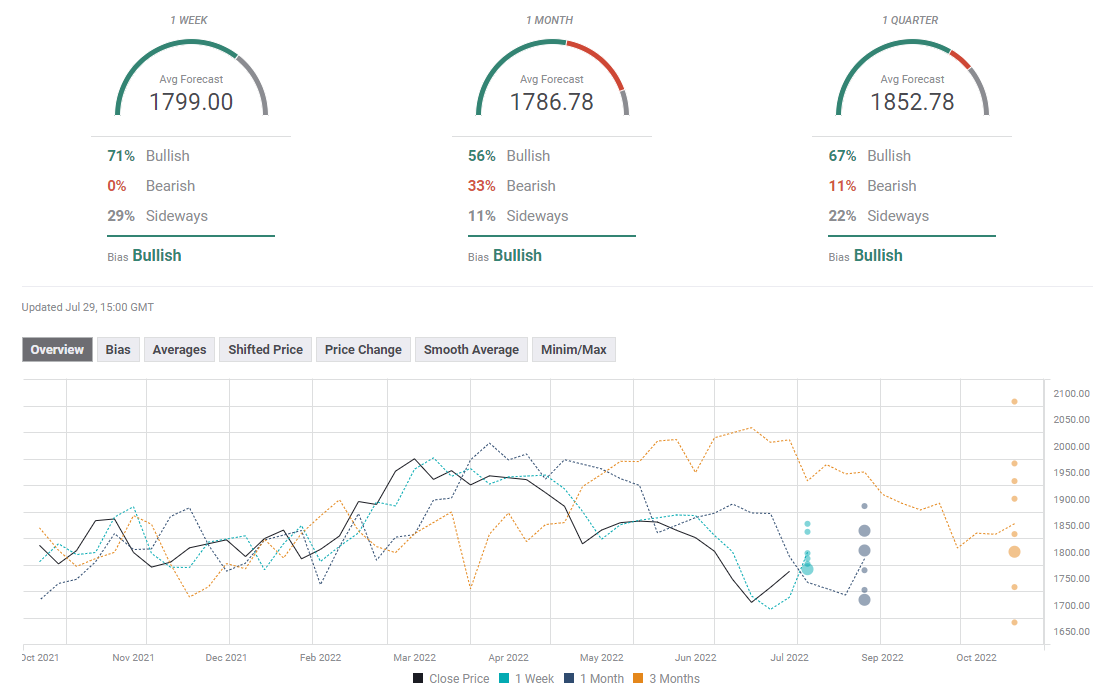

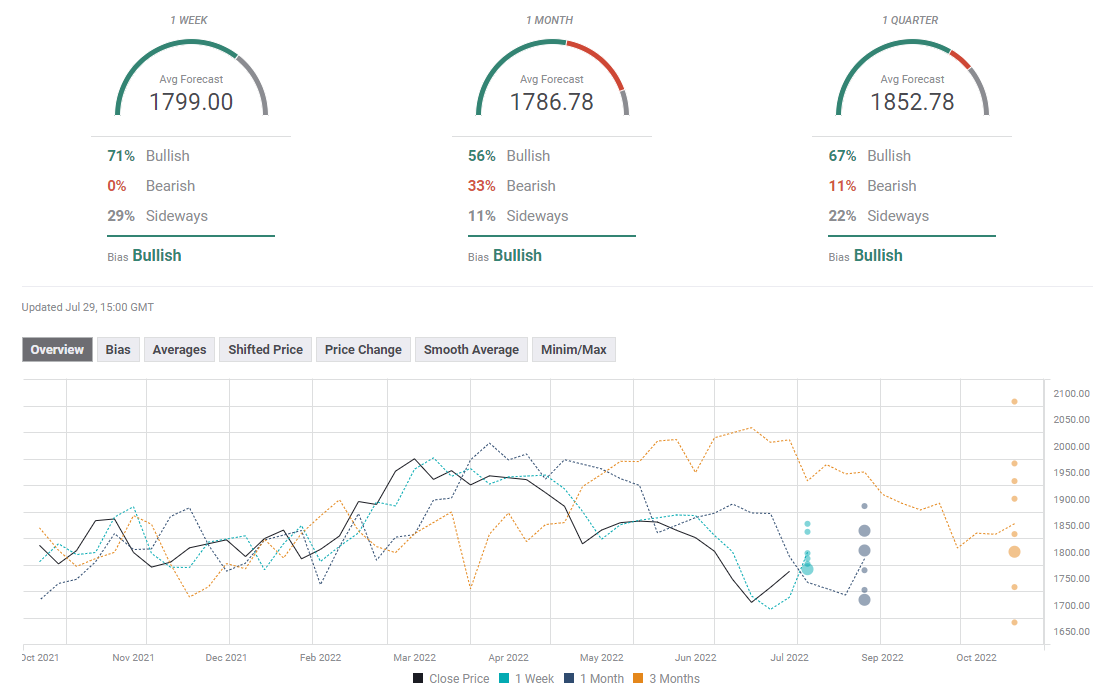

Gold forecast poll

There is an obvious bullish shift in gold's short-term outlook with a majority of polled experts seeing the price continuing to rise next week. The average target on the one-week view sits at $1,799. The one-month view paints a mixed picture with one-third of analysts remaining bearish on gold.