Recession calls are getting louder. If history is any guide, the bust is coming. Good news for gold!

An economic hurricane is coming. Brace yourselves! This is at least what Jamie Dimon suggested last month. To be precise, he said: “Right now, it's kind of sunny. Things are doing fine. Everyone thinks the Fed can handle this. That hurricane is right out there down the road, coming our way. We just don’t know if it's a minor one or Superstorm Sandy.” When JP Morgan Chase’s CEO is painting such a gloomy picture, you know that something serious is going to happen!

Indeed, both on Wall Street and Main Street, calls for a recession are becoming more common and louder. According to Markit, credit default swaps have nearly doubled so far in 2022, surpassing the pre-pandemic levels. The higher their prices, the greater the chance of default in the eyes of investors. The high yield bond market is also showing that worries about the state of the economy are rising. As the chart below shows, the spread between so-called junk bonds and Treasuries surged from about 300 to more than 500 basis points in 2022.

It means that the risk premium – a premium that investors require to hold risky bonds – has risen considerably this year, to the heights of the coronavirus crisis. The implication is clear: market sentiment is deteriorating and confidence in the economy’s strength is declining. The widening credit spreads are usually a good harbinger for the gold price.

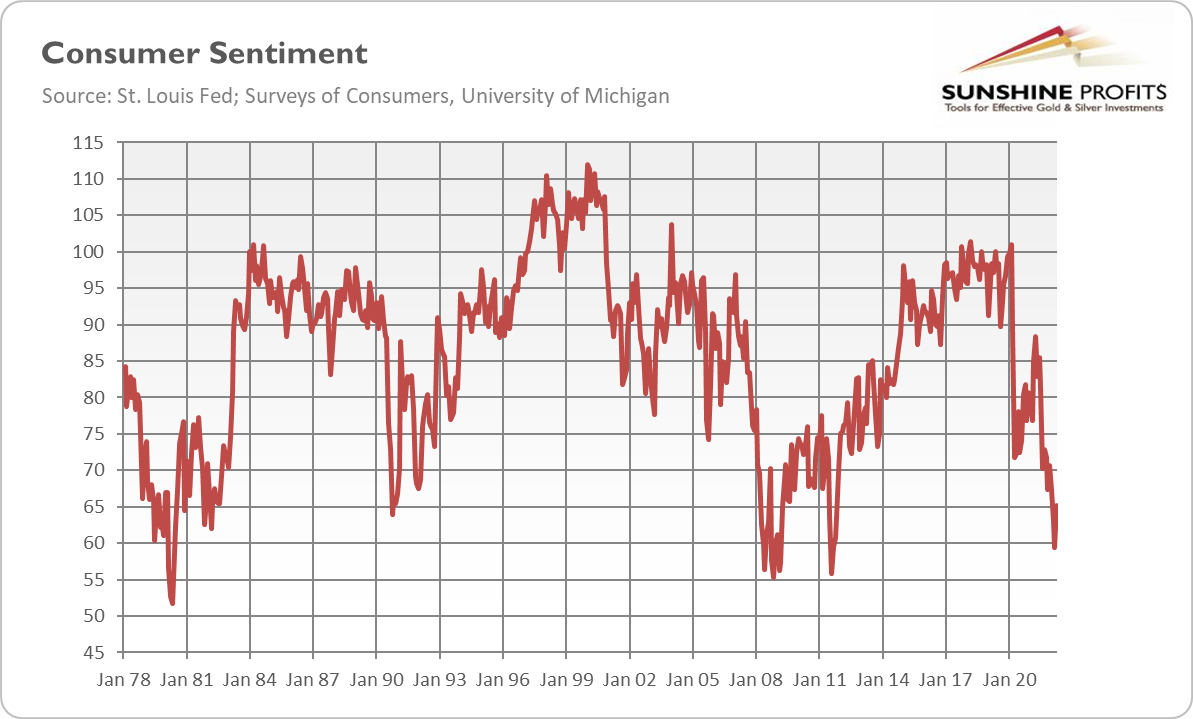

Not only investors have become more worried recently. As the chart below shows, US consumer sentiment as measured by the University of Michigan dived below 60, to a level not seen since the Great Recession and, earlier, the recession of 1980.

Are these concerns justified? I’m afraid so! The Atlanta Federal Reserve’s GDPNow tracker is now pointing to an annualized real GDP growth of just 0% for the second quarter. Atlanta, we have a problem!

To understand what is happening right now, it would be useful to recall the Austrian business cycle theory. According to the Austrian school of economics, there is a phase of boom triggered by the increase in the money supply in the form of credit expansion and the policy of low interest rates that stimulate borrowing and investment, and then the inevitable bust. The bust is imminent as a credit-based boom results in aan imbalance between saving and investment and widespread malinvestments. So, when the credit expansion is slowing down and interest rates are rising, it turns out that many investment projects were not justified by the fundamentals and could be started only because of artificially lowered interest rates and excessive lending. When the bubble bursts, a recession unfolds.

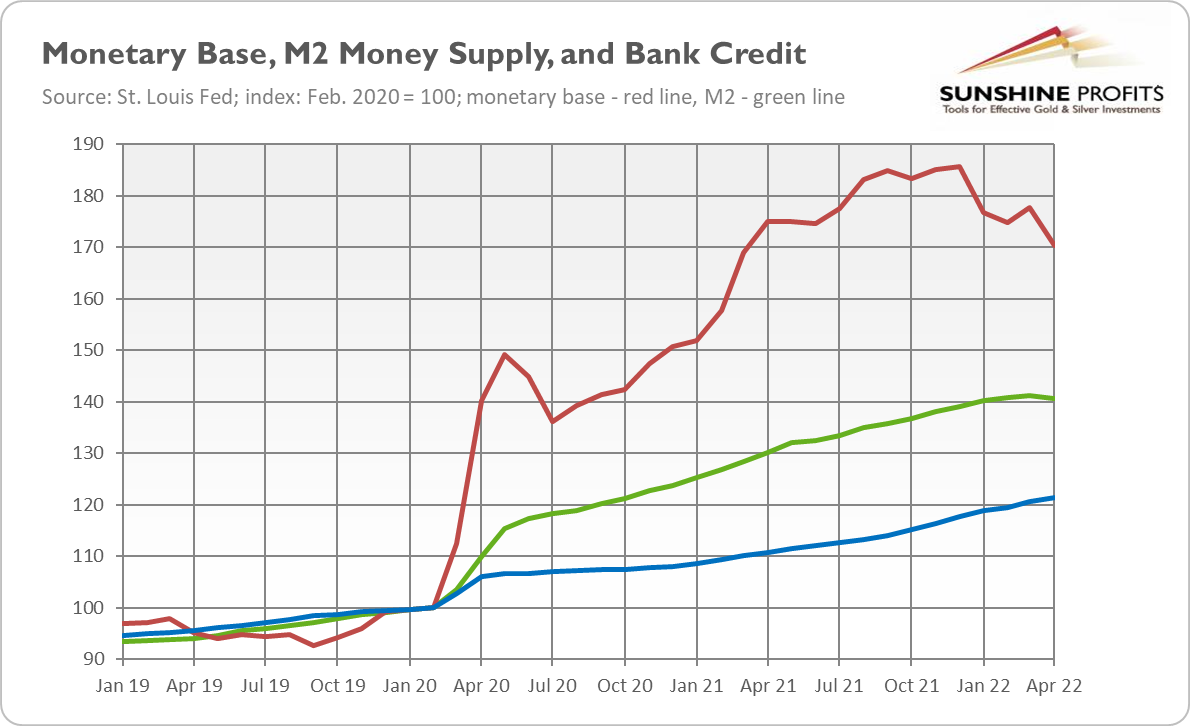

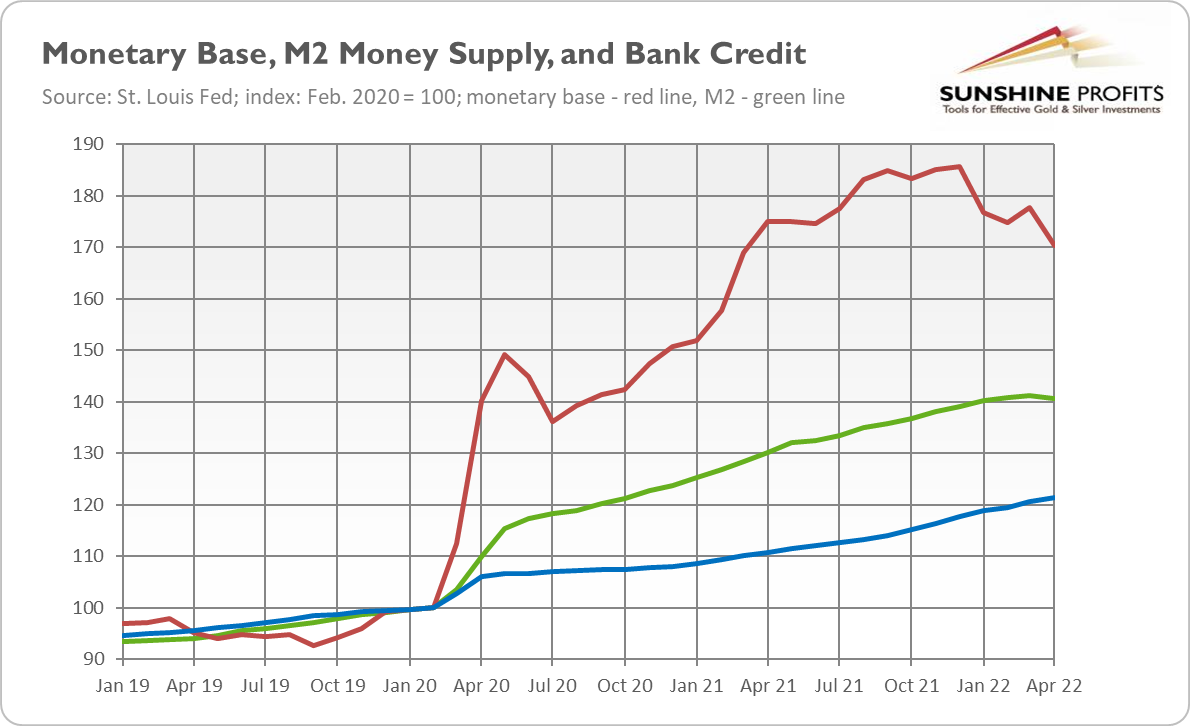

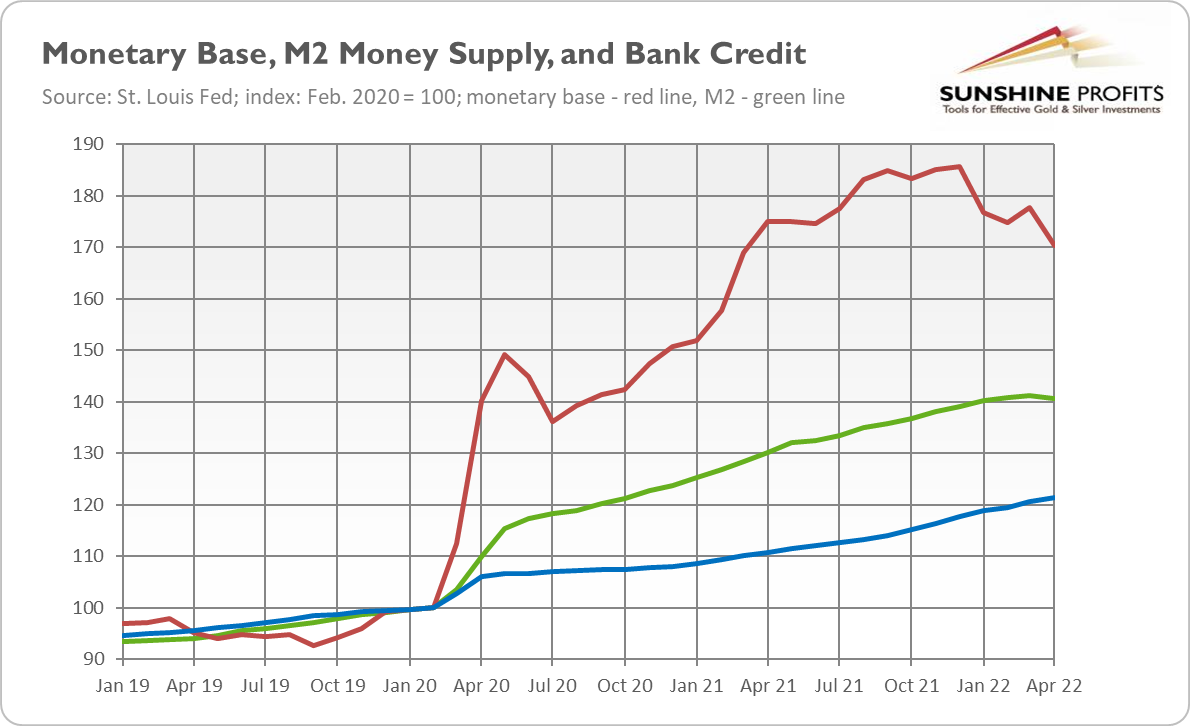

Now, let’s apply this theory to the present situation. In a response to the coronavirus pandemic, governments all over the world panicked and introduced costly lockdowns. To compensate for the losses, the Fed slashed the federal funds rate to almost zero and boosted the monetary base by 40% in just two months. But what distinguished this episode from the previous monetary injections is that the Fed introduced many liquidity programs for Main Street. As a consequence, in the two years after the outbreak of the pandemic, the broad money supply M2 rose by more than 40%, while bank credit increased by about 20% (see the chart below).

As the bulk of this newly created money went to entrepreneurs, they started new investments. However, because input supply had not increased, producer prices soared (as shown in the chart below, producer prices have risen 40% since the pandemic), forcing entrepreneurs to borrow money in the market, driving up bond yields and causing a yield curve inversion. At some point, when interest rates increase too much, entrepreneurs will have to abandon or seriously restructure their projects, triggering a full-scale recession. We are already witnessing some tech companies firing workers in an attempt to reduce costs.

What does it all mean for the gold market? Well, the bust is coming, or, actually – as Kristoffer Hansen points out – the crisis is already upon us. This might be surprising as, typically, business cycles are much longer, but the 2020 monetary impulse was an unusually large but one-time event. This is good news for the yellow metal, which shines during financial crises. Indeed, in the recessionary year of 2008, gold gained 4%, although it initially lost due to fire-sales, and it rallied even more impressively in 2009 and subsequent years. So far, I would say that we are still in 2007, when the stock market has already entered the territory but the real economy hasn’t fallen into recession yet. However, this is likely to change in the upcoming months. If history is any guide, gold will ultimately come out stronger from the crisis.

Summary

Let’s sum up the current edition of the Gold Market Overview. As the chart below shows, June was negative for the yellow metal. The price of gold dropped 1.2% from $1,839 on May 31 to $1,817 on June 30. So, it was a better month than May, in which gold prices fell 3.8%. From its March peak, the yellow metal is down about 11%, but it’s slightly changed year-to-date.

Gold’s performance was actually better than the chart suggests. This is because the yellow metal held its ground amid relatively steep hikes in the federal funds rate. The Fed hiked interest rates by 75 basis points in June, following a 50-basis point raise in May and a 25-basis point liftoff in March. The hawkish FOMC meeting contributed to the plunge in the stock market and cryptocurrencies, but gold remained generally resilient, clearly outperforming other assets. However, in early July, the price of gold sank deeply below $1,800, so the period of resilience could end and the downward wave could start.

Inflation is still very high and it persists even when GDP growth is slowing down. This means that we are approaching stagflation, which should cause gold to rally. The US economy is already decelerating, but the aggressive Fed’s tightening cycle (because it was so terribly delayed) could trigger a recession. The S&P 500 Index has already entered bear market territory, and credit spreads are widening, suggesting a drop in economic confidence. There are also other indications suggesting that the next economic crisis is coming. All this suggests that gold could shine, at least after the currently challenging time.

So far, surging real interest rates are creating downward pressure on gold. However, steep hikes in the federal funds rate imply that we’ll see the peak sooner. What’s important is that Powell is not Volcker and won’t swallow so much economic pain to combat inflation. Even if he was ready to do so, the current, highly indebted economy is not, and when the tightening cycle is over and investors start to expect interest rate cuts rather than further hikes, gold should rally again.