Outlook: The calendar includes industrial production and the Empire State manufacturing index (forecast at -5 from -1.5). Later in the week we get permits and starts, existing home sales, the Treasury capital flow report, Philly Fed, jobless claims, and more, with inflation numbers and the ZEW out of Europe. Information overload, as usual.

It’s hard to ignore Friday’s Atlanta Fed GDPNow update–a tiny drop to 2.8% for Q3 from 2.9% (and based on a tiny drop in real personal consumption expenditures growth. We get another one on Wednesday. Notice how choppy the chart is–way up, then way down, then way up again. Also, the current reading above and outside the blue-shadow most-likely range, so presumably we should expect a drop any time now.

This brings up the question of whether interest rates can or should be based on or at least correlated with economic growth. We’re pretty sure rates should not be zero or negative (ever), but what is the relationship? Conventional economics indicates a rise in rates is inversely correlated to growth and “should” suppress it. But just as low and negative real rates do not necessarily drive fresh growth (only asset bubbles), historical data over long periods of time and after financial crises do not bear this out. In other words, the current conventional thinking is (ahem) wrong. That means inflation targeting in the short-term is bad central bank policy, too, and not just because of our favorite bugaboo, Lag.

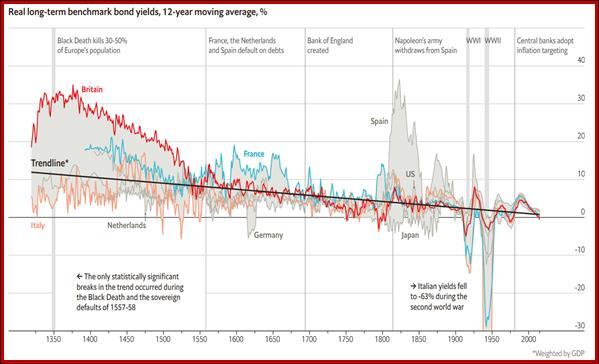

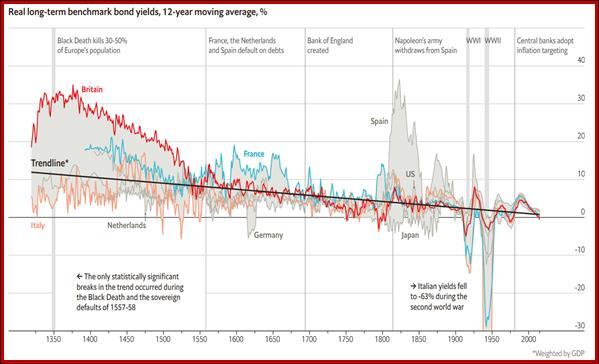

Just for kicks, check out a chart from The Economist last week showing the 12-year average of bond yields weighted by GDP driving relentlessly to zero over centuries. It’s hard to know if The Economist has its tongue in its cheek showing this chart, although the economists behind it seem serious enough. Alternative economists would say this chart misses the point and weighting by GDP is what ruins it. How about a chart showing that real rates and GDP lack a strong correlation? There is a correlation, but it’s weak and inconsistent, and some economists fiddle with the data to adjust the timeframes and other modifications to make lags go away and the model to look accurate. The BIS spent a decade complaining about precisely this point when zero and negative rates failed to boost growth.

The point here is not to quarrel with conventional economics or to embrace the second-tier alternatives, but to point out that if the bond vigilantes are concerned with short-term self-interest, there is a growing cadre of “correct target” vigilantes who see the Fed and other central banks as too little concerned with growth and overly concerned with inflation. The outcome is the same–the Fed will overshoot in its aggressive tightening.

Overshooting is not exactly what the latest WSJ poll says, but it does say the probability of a recession in the next 12 months is 63%, up from 49% in the July survey. The WSJ economists panel expect GDP to contract 0.1% in Q1 and 0.1% in Q2. It’s of some interest that the FT reports comments from several of the US big banks and they do not see any cracks in their business.

Bottom line, again its seems obvious that the dollar can rise alongside rising yields and an aggressive Fed, with two 75 bp hikes now expected before Christmas. That doesn’t mean we won’t get some profit-taking and/or short-covering in other currencies, as we see in sterling now. We could also see some hiving off into emerging markets now that risk-on may be returning now that the UK has fended off a crisis, apparently.

Tidbit: The price action in the stock market last Thursday, which could not in any way be attributed to the inflation report, was weirdly anomalous. The stock market “should” have fallen on the news. Instead it rallied by over 5% and closed up more than 2.5%. We may be getting something similar today–an equity rally just as the WSJ panel of economists forecasts the probability of recession at over 50% for the first time.

This is one of those times when trying to make a cause-and-effect explanation falls flat on its face and raises the question of how much fresh news and/or economic reality affects stock prices. The answer is that most news-based explanations are BS in the first place, a scary thought. How else to figure out what the market will do next? Well, charts. This time the S&P in particular was reaching what looked like a cyclical bottom. Those who bought when selling got exhausted were rewarded. The secret is seeing where sellers run out of steam.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!