Beware of narratives aimed at explaining market reactions, but it's crucial to have a go at the immediate market reaction and reverse course to the latest CPI report showing fresh 40-year high in US inflation. The sharp selloff in indices, metals and bonds lasted no more than 20 minutes, followed by a stabilization that took around 15 minutes before a powerful rally ensued into US lunch time. CPI was indeed hot, but core goods prices were unchanged. What about the action in FX and metals? Any bear market rallies there?

Soaring from the abyss, but Friday always a test

Before we start with FX and metals, it's crucial remind of the implications of bear-market rallies. We saw last spring several instance when market closed up above 2% to return from an intraday loss of 1-2%. Today's bounce in the S&P500 bears more significance as the index is set to close up more than 1% after having fallen by more than 2.5% earlier in the futures session. Most impressively, the rally in the S&P500 emerged to rally of the abyss of 3490 level (50% retracement of the rise from the 2020 lows to this year's highs). It also managed to close above the 200-week MA of 3600.

The other remaining test is Fridays. The last time major indices closed Friday in the green was on September 9th. Today's bullish engulfing candle certainly suggests a Friday up session. But next week is a whole different test.

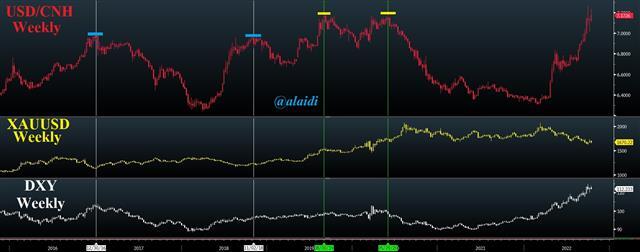

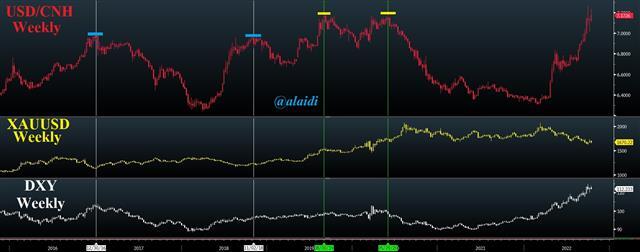

Yuan, US Dollar Index and gold

USDCNH (often a better proxy for USD than the DX index) continued to fail at the 7.20 resistance, coinciding with the twin highs from Aug 2019 and May 2020. The chart shows what happened to gold and DXY after each of those peaks. A similar story ensued at the double top of Dec 2016 and November 2018.

Let's not forget how silver has embarked a on a 6-week uptrend of higher lows, as did copper. Combine this with the inflection points of CNH and XAUUSD and we bulls could start taking October seriously—even though the bigger test remains in November (FOMC and US midterm election)

China observers may also add president Xi Jinping would want a firm currency into next week as the National Congress of the Chinese Communist Party kicks off its 20th edition this Sunday. What if Xi announces a spending-lend growth plan, powering global risk and commodity markets higher? Why not?

DXY shows a similar lower highs formation seen in US 10-year yields or their UK counterpart. But we've seen that pattern before—when DXY stabilizes at the 21-DMA and resumes a fresh run. The more pertinent details are found below.

USD/JPY finally broke above its high from August 1998 high of 147.66 by one pip. The pair is up 22% so far this year, and up 44% from the 2021 lows. The Bank of Japan may have benefited from a shift in attention away from it towards the dangerous battle between the Bank of England and Chancellor of Exchequer. Whether the BoE's emergency gilt-buying program is a stark reminder of what happens if/when the BoJ terminates its yield curve control policy is increasingly being considered by global markets.

But first, will the BoE stick to its decision to end the 13-day gilt-buying program? Will it do so only after a monstrous buying operation? Or will it extend it? These are all band-aid solutions to the real problem of the Chancellor of the Exchequer. Failure to reverse his tax cuts could turn the BoE into the BoJ.