Going into the November meeting markets were fully expecting a 25 bps rate hike. This was despite the latest trimmed mean reading of 6.1% CPI which was on the high side, so there was always a chance of a surprise 50bps hike. In the event, the RBA hiked by only 25bps.

The decision as growth revised lower

Central banks around the world are trying to balance hiking interest rates to control inflation without over-tightening. The risk, for example, that many economists see is that the Fed is on the brink of over-tightening. So, the RBA has one eye on growth and one eye on inflation.

Growth revised lower

The RBA is concerned about slowing growth. They revised growth projections lower to 3% this year and 1.5% in 2023 and 2024. So, the RBA will not want to overreact to inflation, by going too hard on rates for too long.

Inflation expected to peak this year

Inflation is now forecasted to peak at 8% this year before falling to 4.7% over 2023 and just over 3% in 2024.

The reaction

For many central banks, and the RBA is no exception, a slower path of rate hikes is supportive for stocks. The reaction in the AUDUSD pair was an initial drop and the ASX 200 picked up a little.

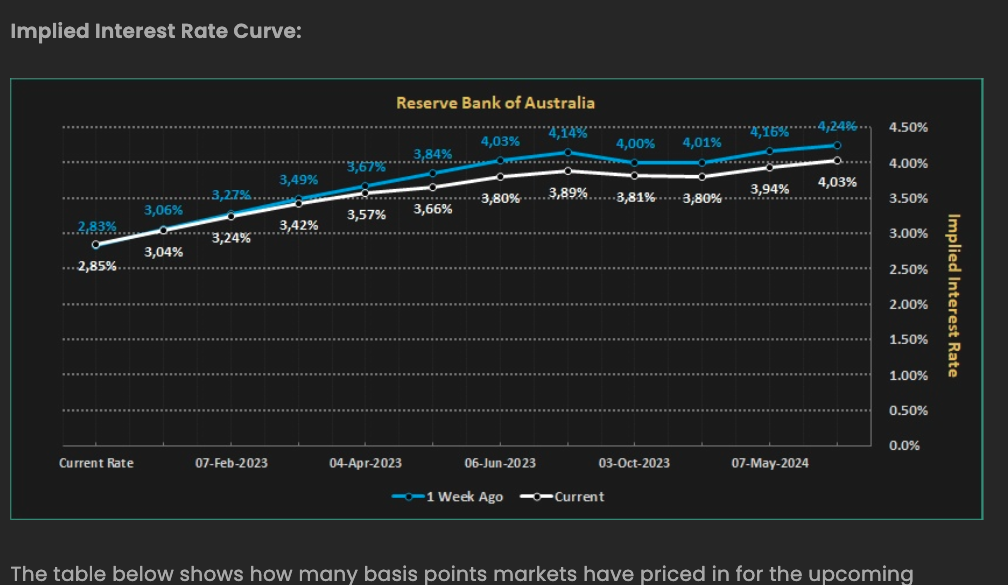

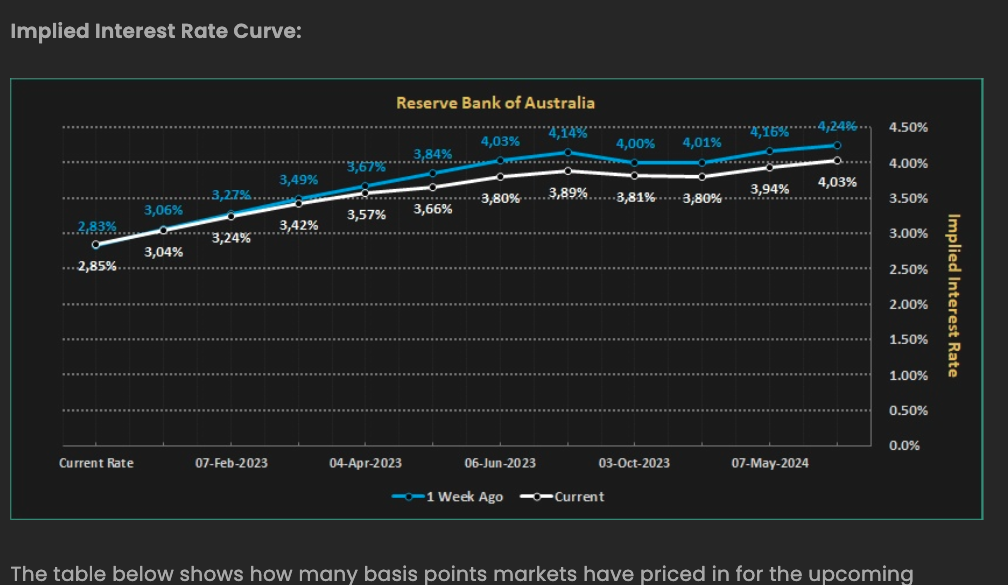

The expectations of slower rate hikes from the RBA are broadly supportive for Australian stocks. The Short Term Interest Rate market reaction the day after the decision is also affirming for a slower rate path ahead. The terminal rate is expected to be just over 4% down from 4.24% prior to the meeting. See the Financial Source Implied Interest Rate Curve tool below.

The RBA also said that it recognises ‘that monetary policy operates with a lag and that the full effect of the increase in interest rates is yet to be felt in mortgage payments. Higher interest rates and higher inflation are putting pressure on the budgets of many households’. So, the bottom line is that the RBA will be data-dependent going forward and will watch the labour market and inflation closely.

Learn more about HYCM