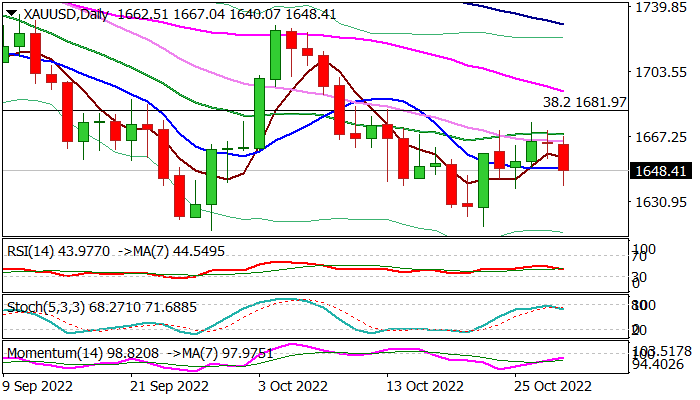

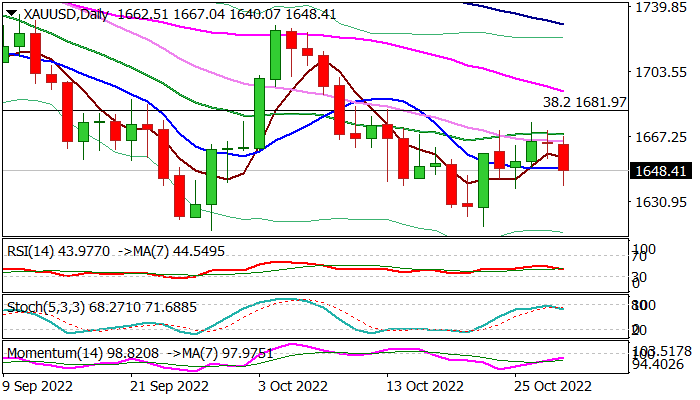

XAU/USD

Spot gold price was down around 1.5% by early US trading on Friday, pressured by stronger dollar on growing expectations that the Fed will deliver another 75 basis point hike in the policy meeting next week. Optimism on further policy tightening inflates dollar, weighing on its safe-haven counterpart.

Fresh acceleration lower has so far retraced over 50% of $1617/$1674 upleg, with the metal being on track for the biggest daily fall since Oct 19.

Weekly action is also going to end in red, with more significant signal that the yellow metal will register seventh consecutive monthly loss.

Weakening daily studies (MA’s turning to bearish setup and momentum remains in negative zone) add to downside risk, which will be boosted by today’s close below $1646 (50% retracement of 1617/$1674/daily Tenkan-sen).

Also, gold price is on track for the second monthly close below pivotal Fibo support at $1681 (38.2% of $1046/$2074) that would add to reversal signals and re-confirm a monthly double-top ($2074/$2070) as well as a double bull-trap above psychological $2000 barrier.

Bears need to clear temporary footstep at $1647 (Oct low, reinforced by rising 55MMA) to open way for attack at monthly cloud base ($1598) and 50% retracement of $1046/$2074 ($1560).

Res: 1652; 1668; 1674; 1681.

Sup: 1639; 1630; 1614; 1598.